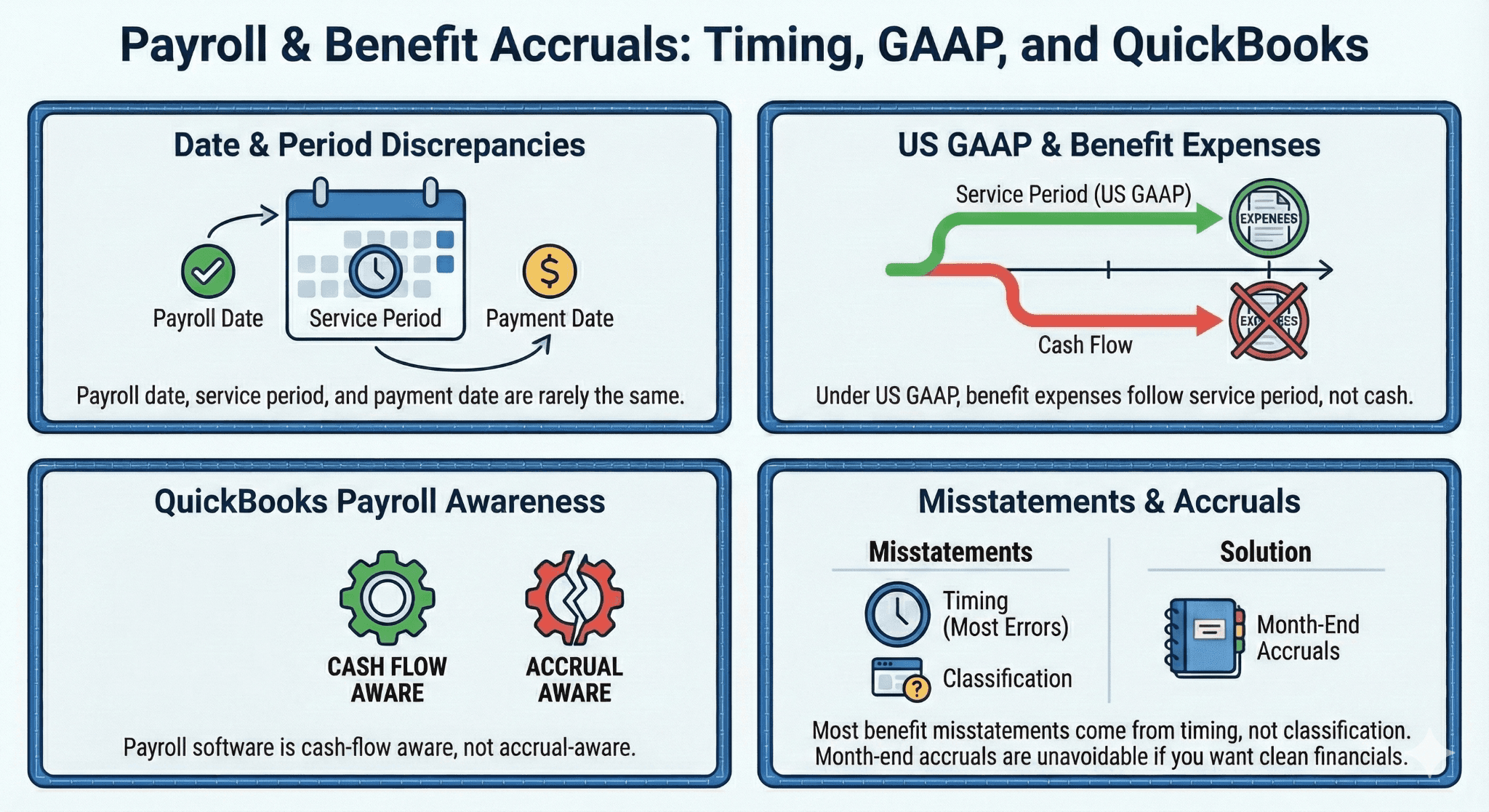

Payroll date, service period, and payment date are rarely the same.

Under US GAAP, benefit expenses follow service period, not cash.

QuickBooks Online payroll is cash-flow aware, not accrual-aware.

Most benefit misstatements come from timing, not classification.

Month-end accruals are unavoidable if you want clean financials

.

Executive Summary

Even when employee benefits are classified correctly, financials still go wrong because of timing. Payroll runs on a date. Benefits are earned over a period. Vendors are paid later. QuickBooks Online connects none of these dots automatically.

The result is predictable. Expenses shift between months. Liabilities linger or disappear unexpectedly. Controllers struggle to explain fluctuations that have nothing to do with actual headcount or benefit changes.

This is not a payroll problem. It is an accrual accounting problem.

QuickBooks Online Online payroll processes transactions when they occur. US GAAP requires recognizing expenses when obligations arise. Those two timelines almost never align for benefits.

This article explains how benefit timing should work under US GAAP, how QuickBooks Online actually behaves, where users get trapped, and how to implement a clean, repeatable accrual process without building a monster spreadsheet.

Why Timing Is the Real Enemy in Benefit Accounting

Most accountants understand the difference between employee-paid and employer-paid benefits. Timing is where discipline breaks down.

Common assumptions that cause errors:

“Payroll was run in March, so the expense belongs in March.”

“The insurance bill was paid in April, so expense it in April.”

“QuickBooks Online payroll already handled this.”

All three are wrong under US GAAP.

QuickBooks Online does not enforce this. It posts based on transaction dates, not service periods.

The Three Dates That Never Match

Every benefit transaction has three relevant dates:

Service Period

When employees earned the benefit.Payroll Date

When deductions and employer portions are calculated.Payment Date

When the vendor is actually paid.

US GAAP cares about the first one.

QuickBooks Online cares about the last two.

That mismatch creates accruals whether you want them or not.

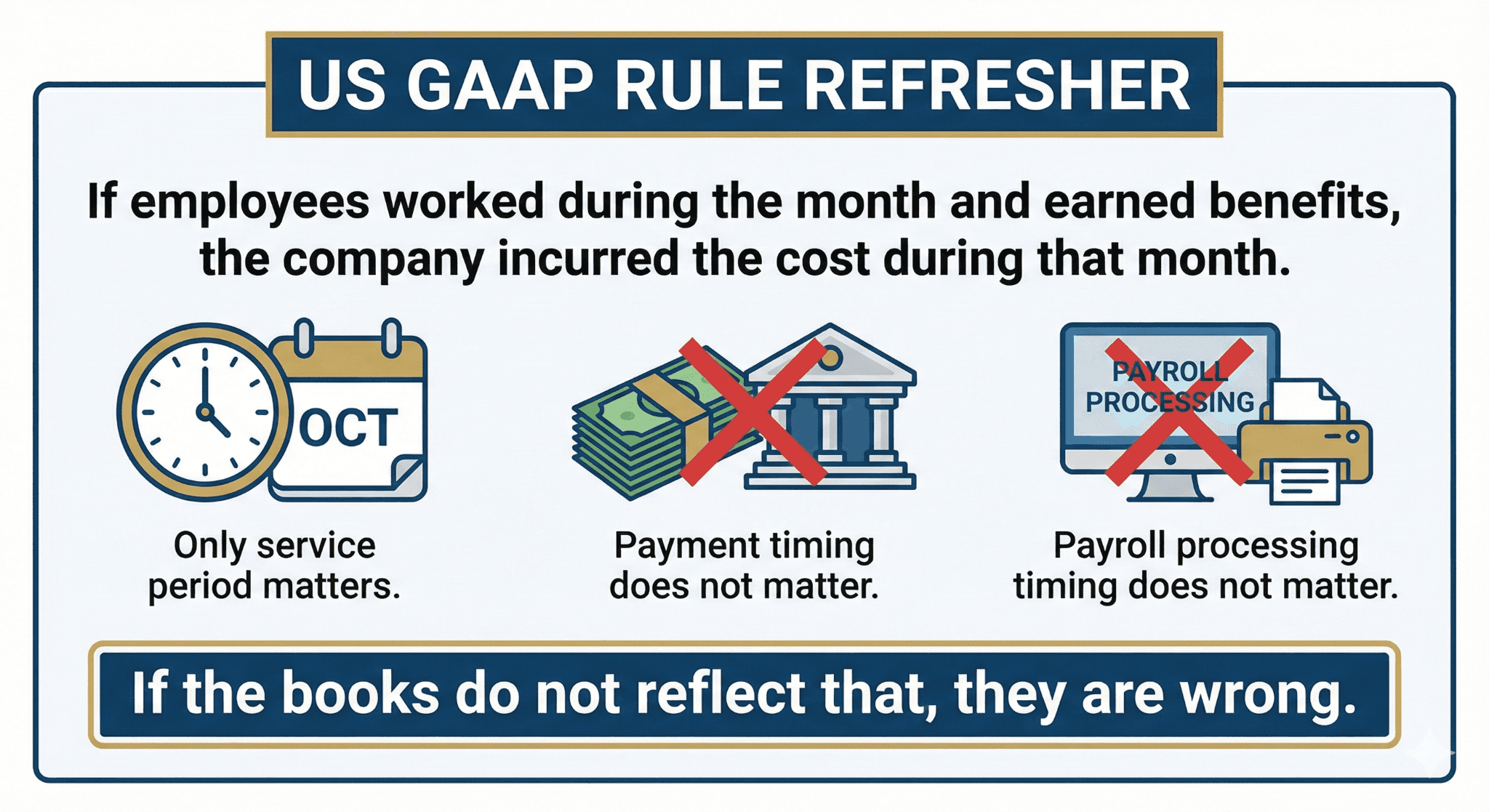

US GAAP Rule Refresher

If employees worked during the month and earned benefits, the company incurred the cost during that month.

Payment timing does not matter.

Payroll processing timing does not matter.

Only service period matters.

If the books do not reflect that, they are wrong.

How QuickBooks Online Payroll Handles Timing (And Why It Is Not Enough)

QuickBooks Online payroll:

Records employer benefit expense on payroll date

Records employee deductions on payroll date

Ignores vendor service periods

Does not auto-accrue unpaid benefits

This is perfectly acceptable for payroll compliance. It is incomplete for financial reporting.

QuickBooks Online assumes you will adjust at month-end.

Most users do not.

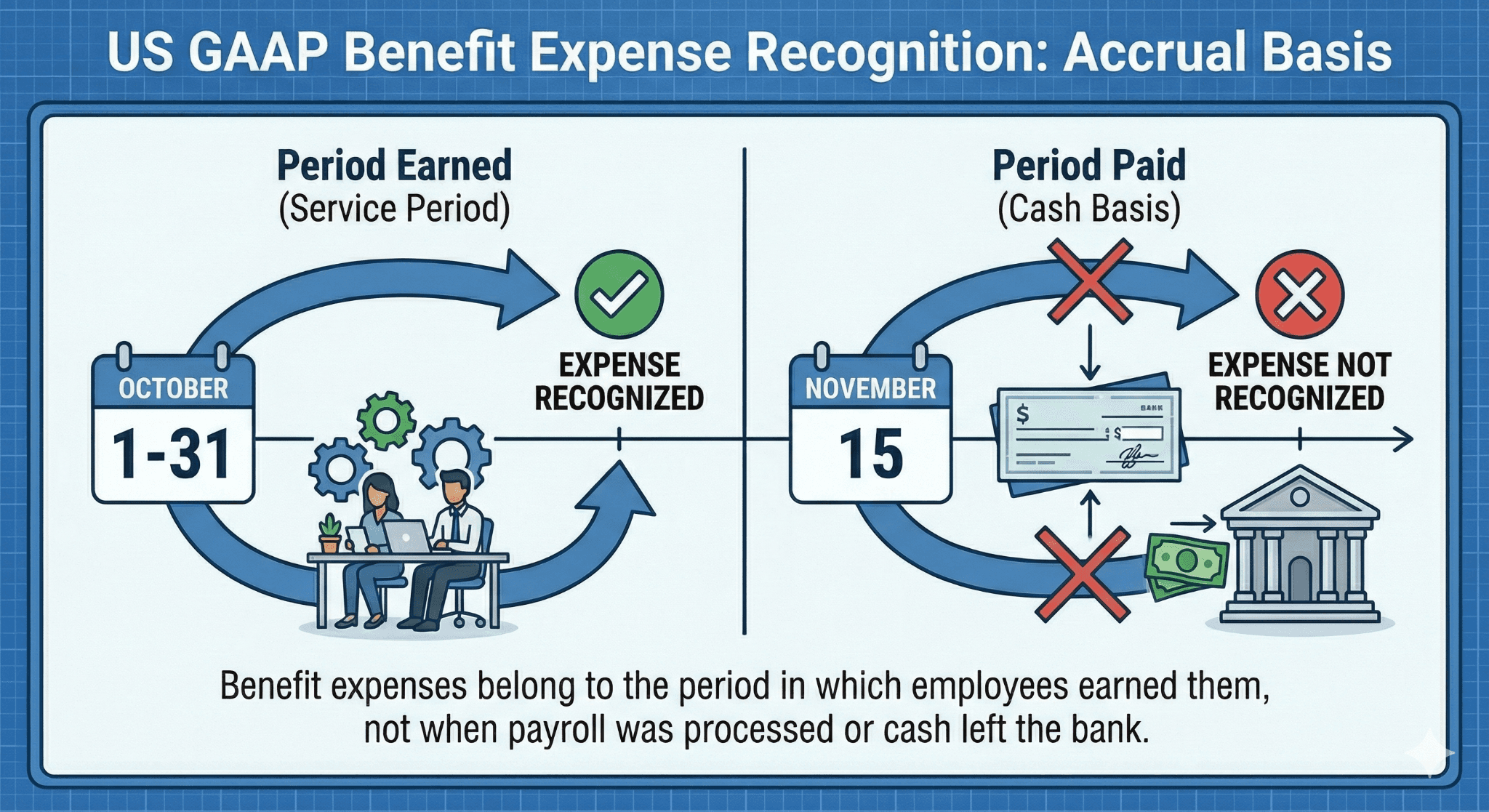

The Most Common Timing Error: Paying Benefits Monthly but Expensing on Payment Date

Example:

Health insurance covers March

Invoice dated April 1

Payment made April 5

Expense recorded in April

Under GAAP, March is understated. April is overstated.

This happens constantly.

Why?

Because QuickBooks Online encourages coding vendor bills directly to expense.

Correct GAAP Treatment for Monthly Benefits

Using the same example:

At March Month-End

Debit: Employer Benefits Expense

Credit: Accrued Benefits Payable

When Bill Is Received and Paid in April

Debit: Accrued Benefits Payable

Credit: Cash or Accounts Payable

Expense stays in March. April reflects only cash movement.

QuickBooks Online does not do this unless you tell it to.

Why Payroll Date Is Still the Wrong Anchor

Some users try to fix timing by relying on payroll date.

That also fails.

Example:

Payroll date: March 28

Coverage period: March 1–31

Payment to vendor: April 5

Payroll date is closer, but still not perfect.

If payroll runs early or late, expenses shift incorrectly.

The only reliable anchor is the service period.

Benefit Accruals You Cannot Avoid

If you issue GAAP financials, you must accrue:

Employer health insurance

Employer retirement match

Employer-paid life or disability insurance

Any benefit earned before payment

Skipping accruals because “it is small” works until it does not.

Auditors notice patterns, not just amounts.

Setting Up Accrued Benefit Liabilities in QuickBooks Online

You need at least one accrual account.

Recommended minimum:

Accrued Employee Benefits (Liability)

Optional but cleaner:

Accrued Health Insurance

Accrued Retirement Contributions

The goal is clarity, not complexity.

Monthly Accrual Workflow (The One That Actually Works)

This is the simplest defensible workflow for SMBs.

Step 1: Identify Coverage Periods

Know what period each benefit covers. Insurance is usually calendar-month based. Retirement matches follow payroll.

Step 2: Calculate Employer Portion

Ignore employee deductions. Focus only on employer cost.

Step 3: Record Month-End Accrual

Journal entry at close:

Debit employer benefit expense

Credit accrued benefits liability

Step 4: Reverse or Clear on Payment

When paid:

Debit accrued liability

Credit cash or AP

Expense should not be hit again.

Handling Partial Months and New Hires

Benefits rarely start exactly on the first of the month.

Common issues:

Mid-month hires

Waiting periods

Prorated premiums

QuickBooks Online will not prorate expenses correctly for GAAP.

You must.

Best practice:

Accrue based on actual coverage days

Do not blindly use invoice totals

Precision matters more here than anywhere else in payroll accounting.

Retirement Match Timing: The Silent Problem

Retirement matches are often paid weeks after payroll.

Example:

Payroll earned in March

Match calculated in March

Paid to provider in April or May

Expense belongs in March.

QuickBooks Online usually records expense when payroll is processed. Payment later is often expensed again accidentally.

Double counting is common.

Correct approach:

Payroll posts expense and liability

Provider payment clears liability

Never expense both.

Reconciling Accrued Benefits Monthly

If accruals are not reconciled, they become fiction.

Monthly checklist:

Opening accrued balance

Plus current month accrual

Minus payments

Equals ending balance

If this does not tie, something is wrong.

Do not carry unexplained balances.

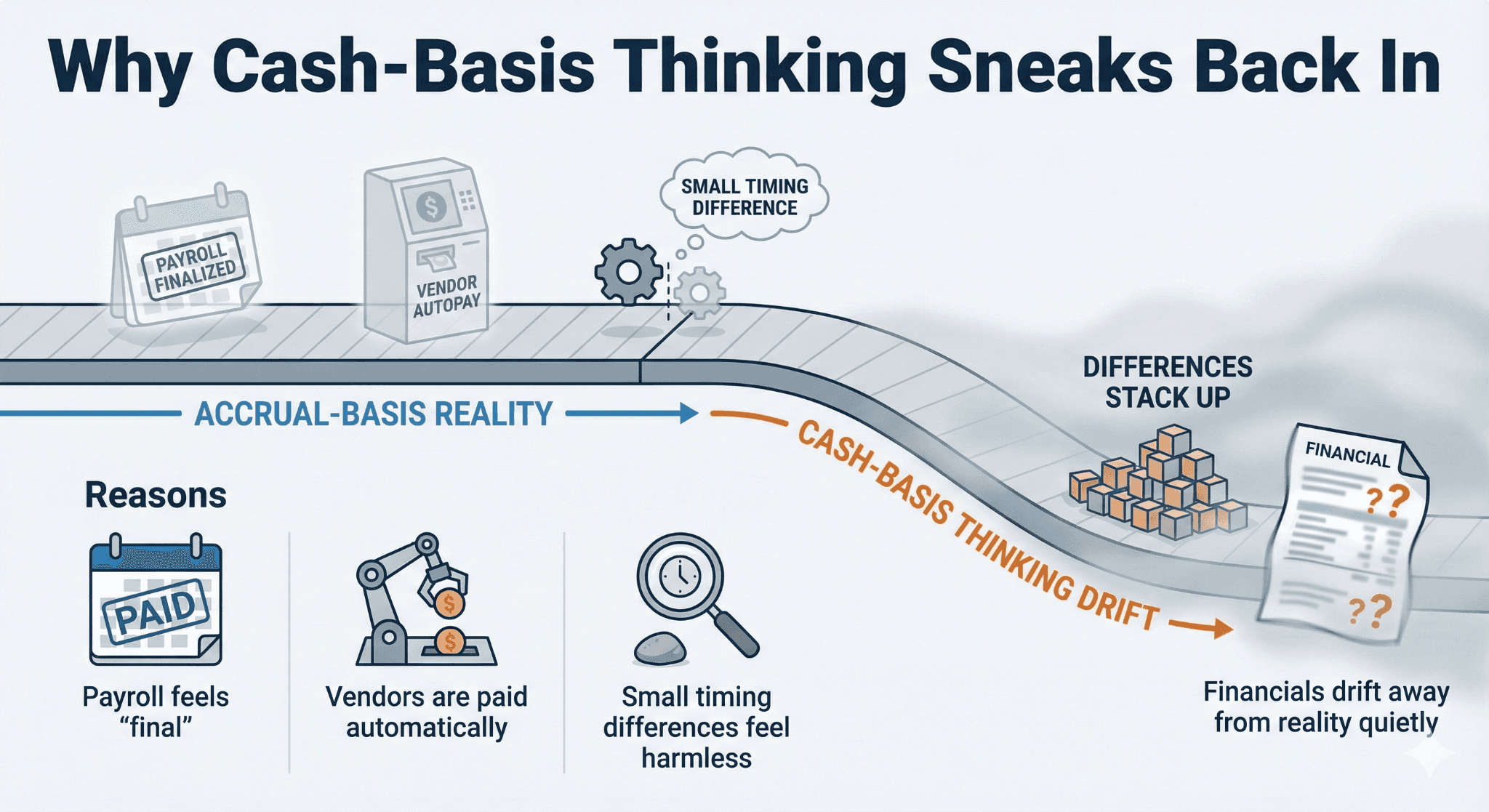

Why Cash-Basis Thinking Sneaks Back In

Even accrual-basis companies behave like cash-basis around payroll.

Reasons:

Payroll feels “final”

Vendors are paid automatically

Small timing differences feel harmless

Over time, these small differences stack up.

Financials drift away from reality quietly

.

Mini-Case: SaaS Company With Volatile Margins

Background

50-employee SaaS company with stable headcount.

Problem

Gross margins fluctuated month to month.

Cause

Health insurance expensed on payment date, not service period.

Fix

Monthly accrual for employer portion.

Result

Margins stabilized. Forecasts improved. Audit adjustments eliminated.

Same payroll. Same benefits. Different accounting discipline.

When You Can Skip Accruals (Rare but Real)

You may skip accruals if:

Benefits are paid within the same month

Amounts are immaterial

Financials are strictly cash basis

Most mid-market companies do not meet these criteria.

If you are issuing GAAP financials, accruals are expected.

Controller View: Why Timing Errors Matter

Timing errors affect:

EBITDA

Gross margin

Operating expense trends

Budget vs actual analysis

They make good management look bad and bad management look random.

Controllers care less about precision and more about consistency.

Accruals provide that consistency.

Tool Comparison: How People Handle This Today

Method | Accuracy | Effort | Audit Risk |

No accruals | Low | Low | High |

Manual JE monthly | High | Medium | Low |

Spreadsheet tracker | Medium | High | Medium |

High | High | Low |

QuickBooks Online users usually land in option two.

Common Audit Findings Related to Benefits Timing

Auditors often flag:

Expenses recorded on payment date

Missing accrued liabilities

Inconsistent month-end entries

Reversals not cleared

These findings are avoidable.

Documentation: Your Best Defense

Document:

Accrual methodology

Assumptions

Coverage periods

Reconciliation process

This matters more than perfection.

Auditors respect consistency and rationale.

Frequently Asked Questions

Does QuickBooks Online automatically accrue benefits?

No.

Is payroll date good enough?

No.

Can I just expense insurance when paid?

Only if cash basis.

Do auditors expect accruals?

Yes, for GAAP financials.

Is this overkill for small companies?

Not if they care about accurate margins.

Glossary

Service Period

Time during which employees earn benefits.

Accrued Liability

Expense recognized before payment.

Timing Difference

Mismatch between earning and payment.

Reversal

Clearing accrual when paid.