Why QuickBooks Online cannot manage a reliable 13-Week Cash Flow Forecast (and how to fix it)

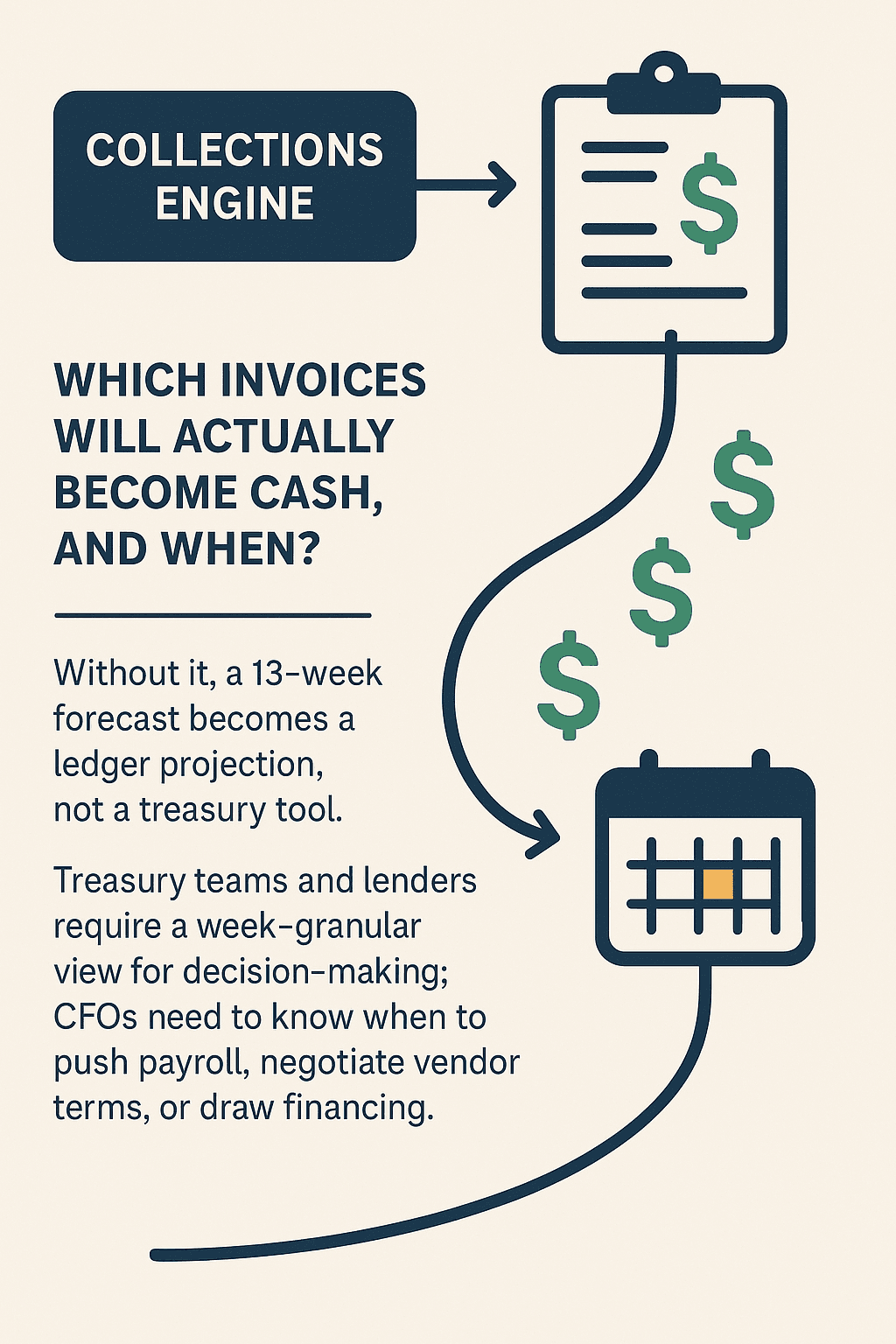

QuickBooks online shows invoices and a Cash Flow Planner but not a collections engine that converts AR into weekly receipts.

Build weekly “collection buckets” (week-1, week-2, week-3+) from QuickBooks online invoice and payment history.

Calibrate buckets by customer segment or invoice type using 3–12 months of payment history.

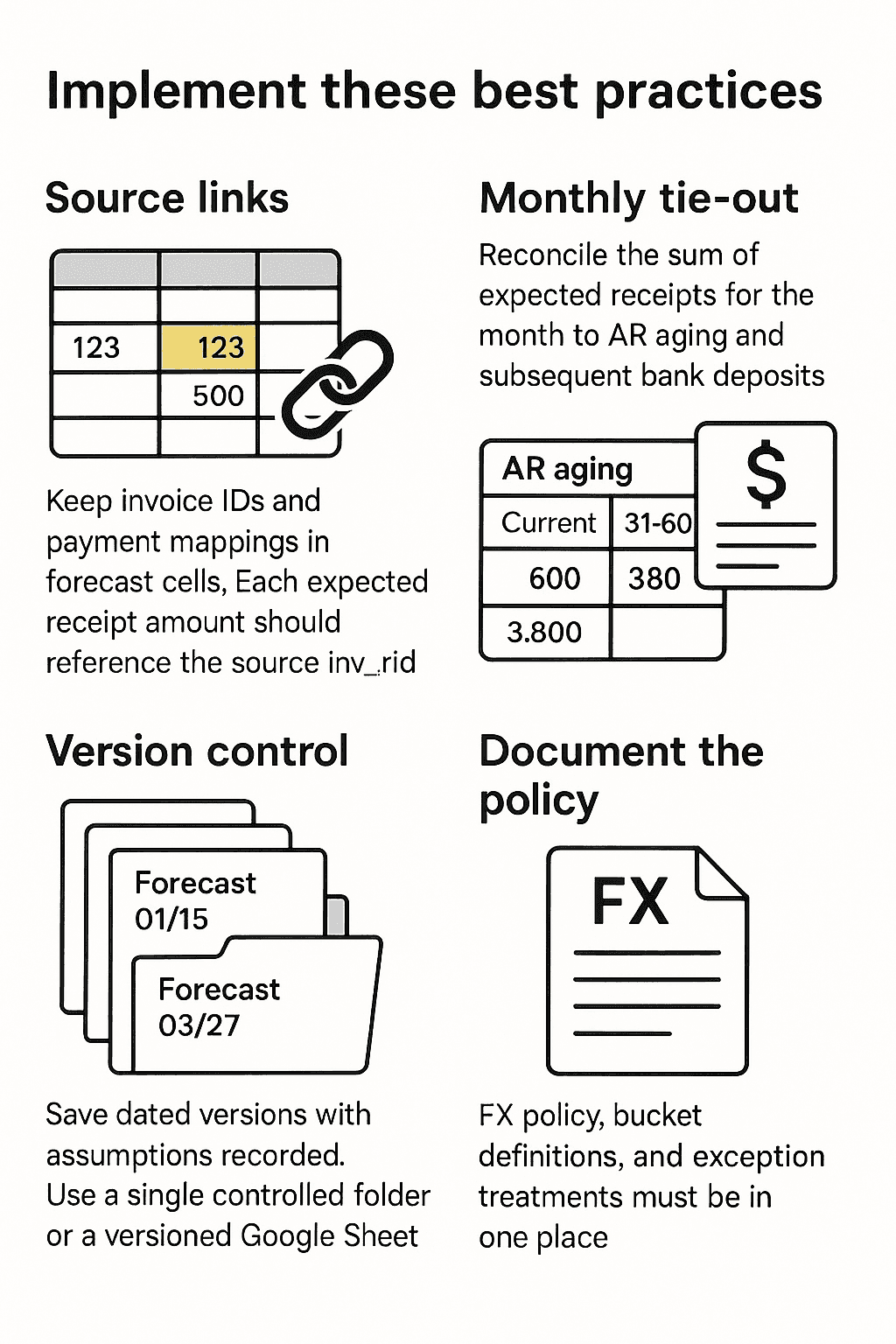

Reconcile every forecast cell back to specific QuickBooks online invoice lines and bank deposits for auditability.

For multi-entity or multi-currency consolidations add strict FX and elimination rules.

Executive summary

A 13-week forecast is the treasury standard for short-term liquidity. QuickBooks online stores the data required for such a forecast—open invoices, payments, and bank balances—but it does not convert that data into a probability-graded, week-by-week cash receipt stream. Accountants and controllers therefore export QuickBooks online data into spreadsheets and build bespoke collections models. Those models work, but they are fragile, slow, and hard to audit. This guide explains a practical, repeatable method to convert QuickBooks online AR into a robust weekly cash forecast: extract the right fields, cleanse the data, define collection-percentage buckets, calibrate by historical payment behavior, account for exceptions (disputes, partial payments, refunds), and reconcile the forecast back to QuickBooks online trial balance and bank statements. The result is a 13-week forecast that is both actionable and auditable.

1. Why a collections engine is central to a 13-week forecast

QuickBooks online gives you the ledger facts: invoices posted, payments received, and bank balances. It also offers a Cash Flow view that displays a 13-week chart in many versions. That is useful, but it is not the same as a collections engine—a model that converts individual invoices into expected weekly cash receipts using calibrated probabilities and customer behaviour profiles.

2. What to export from QuickBooks online (and why)

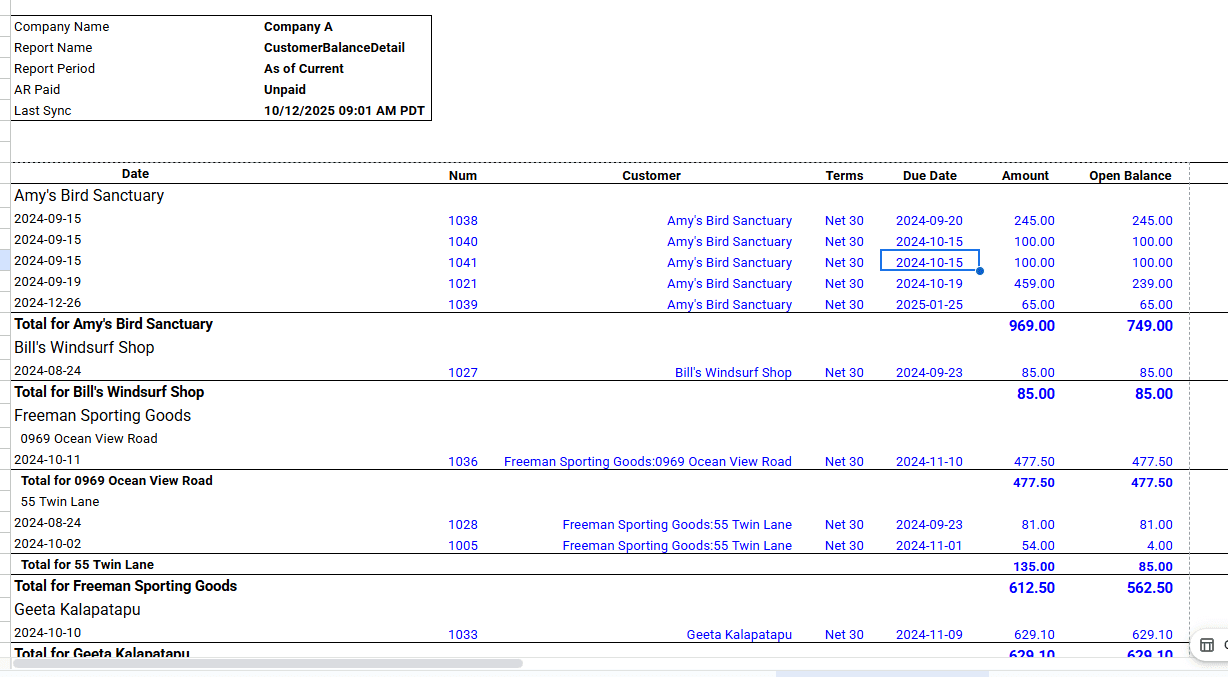

Start with the minimum data set. Export these fields for all open invoices and a history window of 3–12 months of paid invoices to calibrate behaviour:

invoice_id,customer_id,invoice_date,due_date,invoice_amount,open_balance— core invoice detail.customer_terms,classorlocation(if used),tag— for segmentation.payment_history(invoice level) — to compute historical days-to-pay.unapplied_creditsandrefunds— to handle net receipts.bank_deposit_idmapping (if available) — aids reconciliation.

Intuit guidance shows a 13-week graph and cells you can edit, but the granular mapping above is not exposed as a native collections model; that is why export is necessary.

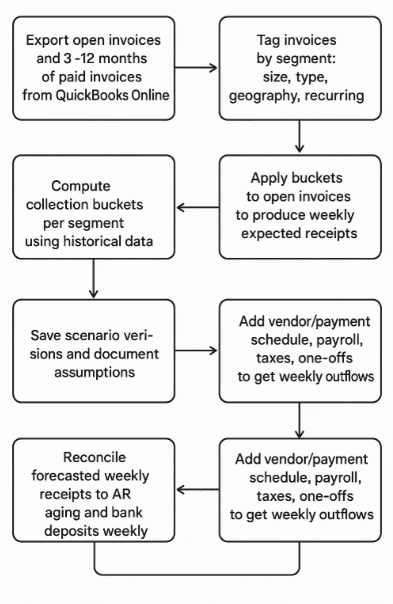

3. Step-by-step: build weekly collection buckets

Step 1 — Cleanse and tag

Import the export into google Sheets or using FinBoard.ai. Normalize date fields and standardize customer identifiers. Tag customers into segments that matter: large vs small, industry, geography, credit terms. Tag invoice types: recurring, one-time, milestone, retainers.

Step 2 — Historical calibration

If every bill and invoices are paid and collected as per terms with the party then historical calibration is not needed. If more unexpected payment and collection happened in the past, then Use 3–12 months of paid invoices to compute payment behavior per segment. Calculate distribution of collection timing: percent collected in week 1 (0–7 days), week 2 (8–14 days), week 3 (15–21 days), and remaining (22+ days). Also compute write-offs, average days-to-pay, and variance.

Step 3 — Assign forward expectations

For each open invoice, apply the collection percentages for its segment to convert open_balance into expected weekly cash amounts. Example: $1000 invoice in segment A with buckets {w1:40%, w2:35%, w3+:25%} becomes $400 in week1, $350 in week2, $250 beyond.

Step 4 — Adjust for known exceptions

Flag invoices in dispute, on hold, subject to refunds, or under payment plans. For disputes, set collection probability to near zero until resolution. For partial pays, adjust expected receipts to net expected remainder. Keep a manual exceptions log to override modelled expectations.

Step 5 — Build the weekly roll-forward

Roll the expected receipts into the 13-week table: opening bank + expected receipts — expected outflows (AP, payroll, taxes) = projected closing bank per week. Integrate vendor schedules and payroll theatre to complete the model.

Step 6 — Sensitivity & scenario

Create alternate buckets for stressed scenarios (e.g., collection rates decrease by 20%): duplicate the sheet and apply stress factors. Scenarios should be quick to recompute when CFO asks “what if receipts slow by two weeks?”

4. Calibration & segmentation: the difference between plausible and useful

A single blanket DSO assumption is rarely adequate. Payments often cluster by customer type, invoice size, and geography. Calibration is the step that makes the 13-week forecast credible.

Recommended segments to calibrate:

Large clients (>$50k invoices) — often slower or scheduled payments.

Small invoices (<$1k) — tend to pay faster.

Recurring subscription invoices — predictable timing.

Project/milestone invoices — lumpy, often withheld until milestone acceptance.

Compute for each segment:

avg_days_to_paypct_collected_w1,pct_collected_w2,pct_collected_w3plusavg_partial_payment_ratedispute_rate

Use at least 3 months; 12 months if seasonal effects exist. Wall Street Prep and FE.training outline the mechanics for direct-method 13-week models and emphasize calibration to avoid over-confidence in forecasts.

5. Edge cases: disputes, refunds, partial pays, FX

Disputes and holds: Mark as near-zero likelihood until release. Do not include disputed amounts in week-one cash unless evidence suggests an imminent resolution.

Partial pays: Split the invoice into paid portion (already cash) and expected remainder; model the remainder according to historical partial-pay patterns.

Refunds/chargebacks: Apply historical reversal rates to recent periods to include likely outflows.

FX impacts (multi-currency): Apply a policy: e.g., convert foreign local receipts to reporting currency using the treasury policy rate for the week or quarter. Inconsistency here produces artificial volatility in consolidated forecasts. Liveflow and treasury guides recommend a single policy and document it.

6. Reconciliation and audit trail — non-negotiable

Intuit’s planner allows limited adjustments, but it will not produce the granular, auditable mapping required; that is why a disciplined export + reconciliation is critical.

7. Quick start checklist (practical)

Tool / Workflow comparison (short)

Task | QuickBooks online only | Spreadsheet model | QuickBooks online→FinBoard.ai Plugin (Sheets/Tool) |

Extract invoice data | ✅ | ✅ | ✅ |

Calibrate bucket percentages | ❌ | ✅ (manual) | ✅ (reusable templates) |

Scenario stress tests | ❌ | ✅ (copy tabs) | ✅ (quick recompute) |

Audit traceability | Partial | Fragile | ✅ (link back to invoice ids) |

Multi-entity FX policy | ❌ | Manual | ✅ (policy application) |

Weekly refresh time | Low | High | Low |

Mini-Case (QuickBooks online-centric)

“We are a SaaS company operating in the United States and India. Our CFO wants a rolling 13-week cashflow forecast. QuickBooks online gives us reports of historical cash balances and transactions, but it does not show future obligations in a weekly cadence. We are forced to pull data into spreadsheets, but reconciling invoices, payroll, vendor bills, and subscription collections across entities is messy. How do we build a reliable 13-week forecast without spending days on manual work?”

Step 1: Understanding the Problem

QuickBooks Online was built primarily for bookkeeping, invoicing, and statutory reporting. While QuickBooks online includes a “Statement of Cash Flows,” it is a historical view. It looks backwards, not forwards.

For a 13-week rolling forecast, the CFO needs:

Cash inflows – expected customer receipts, subscription renewals, and ad-hoc sales.

Cash outflows – payroll runs, vendor bills, loan payments, and tax obligations.

Timing alignment – matching when money actually leaves the bank, not just when the expense is recorded in the general ledger.

Multi-entity consolidation – one entity in USD, another in INR, both needing weekly aggregation.

QuickBooks online does not offer these in a single workflow. The CFO and finance team end up exporting Accounts Receivable aging, open bills, payroll schedules, and bank balances into Excel.

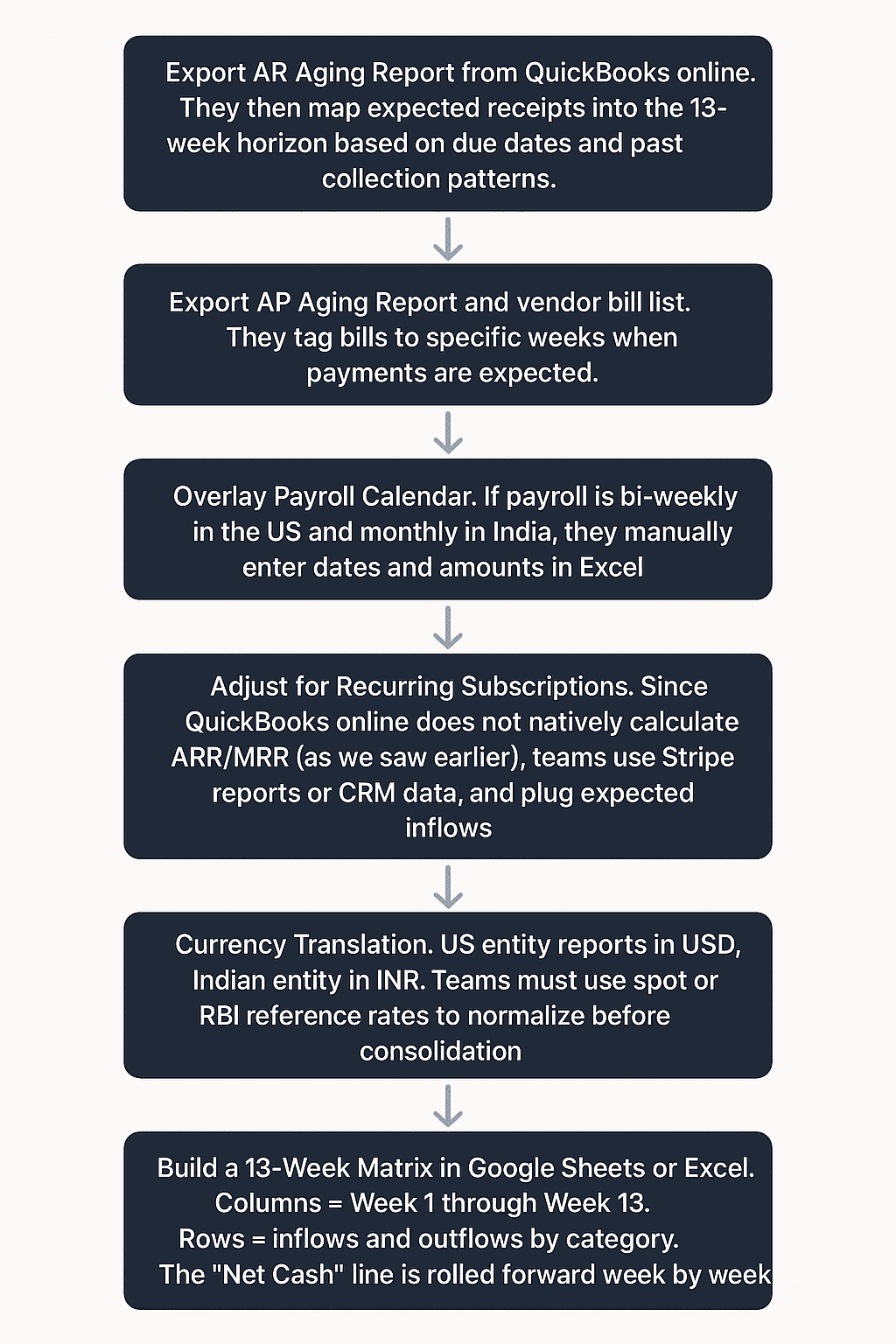

Step 2: The Manual Workflow (Without FinBoard.ai)

Here is what most controllers end up doing today:

This process works, but:

It takes 2–3 days every month.

Forecasting accuracy is highly dependent on assumptions hidden in spreadsheets.

No audit trail exists—hard to explain to auditors or the Board.

Updating when a customer pays late or payroll changes requires rewriting formulas.

Step 3: Real-Life Practical Scenario

Company Profile:

SaaS startup, Series B funded, HQ in Delaware (USD).

Development center in Bengaluru, India (INR).

Annual Revenue: $10M (80% subscription, 20% services).

Headcount: 120 employees across two geographies.

Cash Flow Challenge:

U.S. payroll runs bi-weekly ($350k each run).

India payroll runs monthly on the 30th (₹1.2 Cr).

Large AWS vendor bill every month ($60k).

Two enterprise customers consistently pay 45 days late, affecting inflows.

Currency volatility between INR/USD causes swings in consolidated cash balance.

When the CFO sits with the finance manager, they quickly realize:

QuickBooks online shows current bank balances and outstanding invoices, but not the weekly schedule.

Google Sheets has become the de facto “forecast engine,” but formulas break when the headcount grows or when a new entity is added.

Forecasting 13 weeks forward requires constant “what if” adjustments (what if the Indian payroll is delayed two days due to a bank holiday, what if AWS charges spike by 20%).

Step 4: With FinBoard.ai Workflow (Answering the Question)

Here is how the company solved it with FinBoard.ai:

Direct Sync with QuickBooks online: FinBoard.ai connects to QuickBooks online Online and automatically pulls AR, AP, and bank balances.

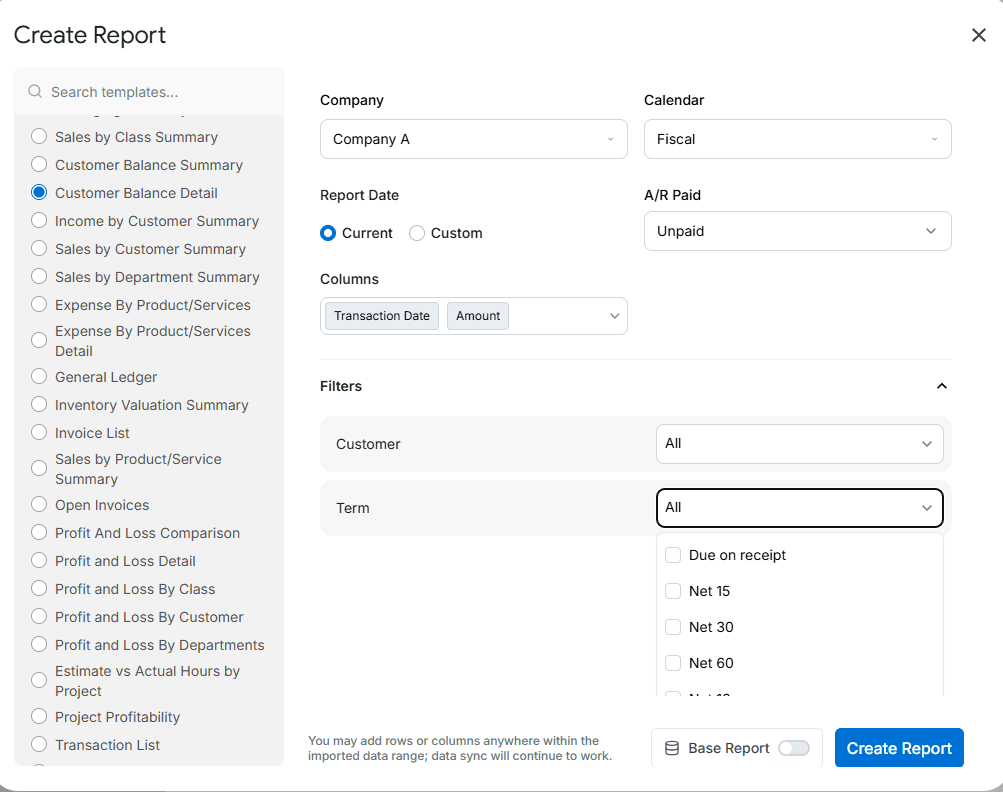

Below are the use cases where Finboard.ai pulls data from QuickBooks Online for creating a forecast model.

Cash Inflow Mapping: The tool applies payment behavior logic. If Customer A has a credit period of 15 days, and the invoice becomes due on Net 15 basis, the system shifts expected receipts accordingly.(Filter > Term > Net 15)

Cash Outflow Templates: Payroll, AWS, rent, and loan repayments are scheduled in weekly templates. Changes to headcount or vendor contracts are automatically updated.

Multi-Entity Consolidation: INR and USD are translated at a chosen policy (RBI reference rate at month-end). The CFO can instantly see a USD-consolidated 13-week view.

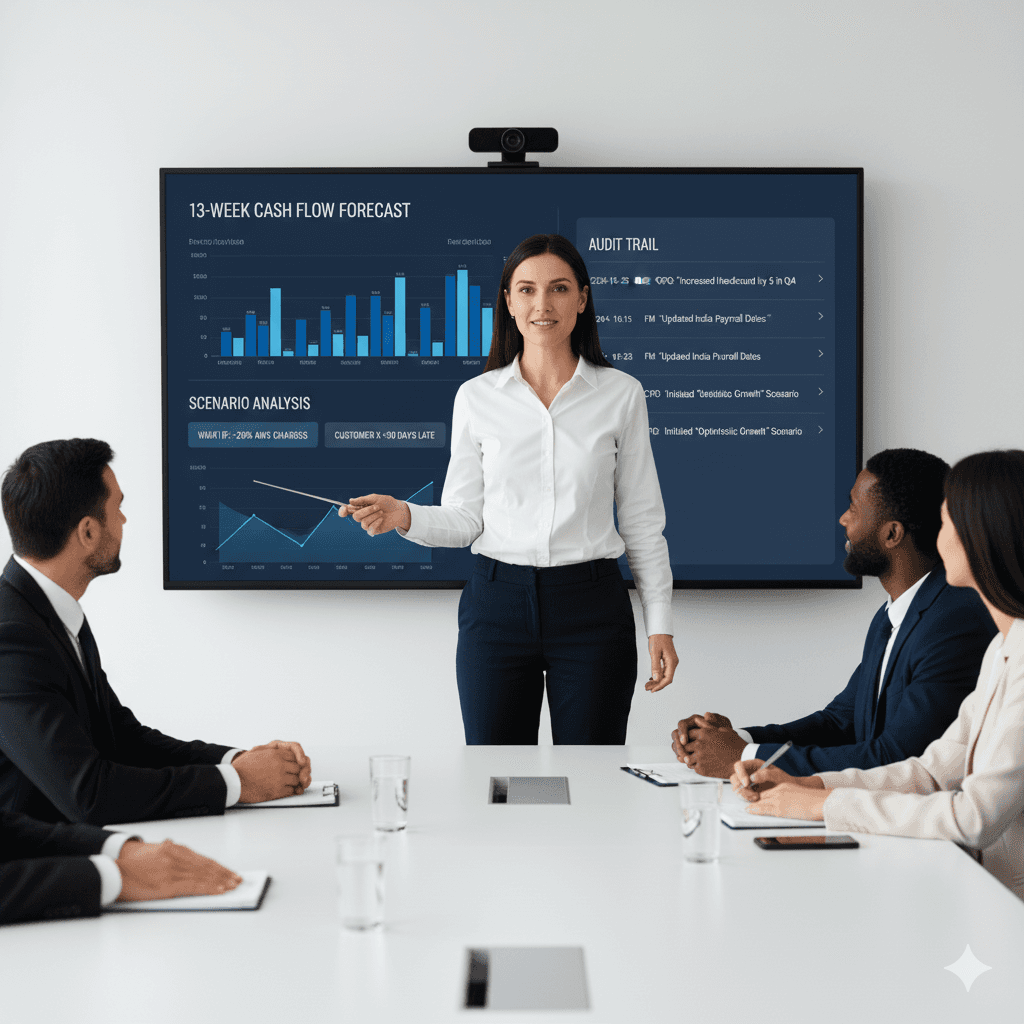

Scenario Analysis: With one click, the CFO can model “What if AWS charges are 20% higher” or “What if Customer X pays 30 days late.”

Audit Trail: Every adjustment is logged. The CFO can show the Board not only the forecast, but also the assumptions behind it.

Step 5: The Detailed Answer

The real answer to the CFO’s question is:

QuickBooks online alone cannot provide a 13-week forecast, because it is designed for bookkeeping, not forward-looking treasury management.

Manual spreadsheets are the fallback, but they introduce risks: errors, broken formulas, and lack of transparency.

A structured workflow (like FinBoard.ai layered on top of QuickBooks online) turns a messy 3-day exercise into a repeatable 2-hour process.

FinBoard.ai template for Bi-Weekly forecast

You can refer the Bi-Weekly forecast template of FinBoard.ai in

This template can be used for almost for all the business with required additions / alterations according to the needs of the users.

Users can download this template from FinBoard.ai for free.

Risks & Mitigations (summarised)

Risk: Over-optimistic buckets lead to liquidity surprise.

Mitigation: Use conservative stress scenarios (reduce collection rates by 10–25%) and present both base and stressed forecasts.Risk: FX inconsistency across entities.

Mitigation: Define and document a single FX translation policy for the forecast.Risk: Auditors question forecast provenance.

Mitigation: Maintain a line-by-line mapping from forecast cell → invoice_id → bank deposit evidence.

FAQ (4–6 Q&A)

Q1: Can QuickBooks online produce a reliable 13-week forecast out of the box?

No. QuickBooks online provides a Cash Flow Planner and 13-week graph in some versions, but it lacks a probability-based collections engine needed to convert AR into weekly receipts. Exports and models are still required.

Q2: How many months of payment history should I use to calibrate buckets?

Use at least three months; use twelve months when seasonality is material. Longer histories improve statistical reliability for large customers.

Q3: Should we create one bucket set company-wide or per customer segment?

Segment calibration is best practice. Large customers often behave differently than small ones. Segment buckets reduce forecast error.

Q4: How often should the 13-week forecast be updated?

Weekly updates are standard. Update more frequently in distressed situations.

Q5: How to handle disputed invoices in the forecast?

Set expected collection probability to near zero until resolution. Track disputes in an exceptions register.

Glossary

AR aging: Ageing schedule of unpaid invoices.

DSO: Days Sales Outstanding; average days to collect receivables.

Collection bucket: Percentage breakdown of when an outstanding invoice is expected to be collected (week1/week2/week3+).

Cash roll-forward: Opening cash + inflows − outflows = closing cash for each period.

FX translation policy: Rules for converting foreign currency receipts into reporting currency.