Executive Summary

For accountants, controllers and bookkeepers managing multiple QuickBooks Online company files, the consolidation challenge is real. QuickBooks Online stores each entity separately, lacking built-in support for combining ledgers, performing eliminations or translating foreign currencies. This leaves many finance teams exporting to spreadsheets and manually stitching together “group” reports — a heavy and error-prone exercise. Reviews and practitioner write-ups consistently point to dedicated tools like FinBoard.ai as the practical solution.

In this guide, we cover the five leading consolidation tools for QuickBooks Online: FinBoard.ai (via Google sheet), LiveFlow (spreadsheet-native), Fathom (performance reporting), Qvinci (franchise/multi-location focus), Spotlight Reporting (board-pack and advisory firm fit) For each we highlight functionality, strengths, limitations and best-fit use case. Then we provide structured selection criteria, a quick-start checklist, a mini case, risks and mitigations, FAQs and a glossary. By the end, you will know how to choose and implement the right consolidation tool for your QuickBooks Online ecosystem.

1. Why QuickBooks Online requires a consolidation tool

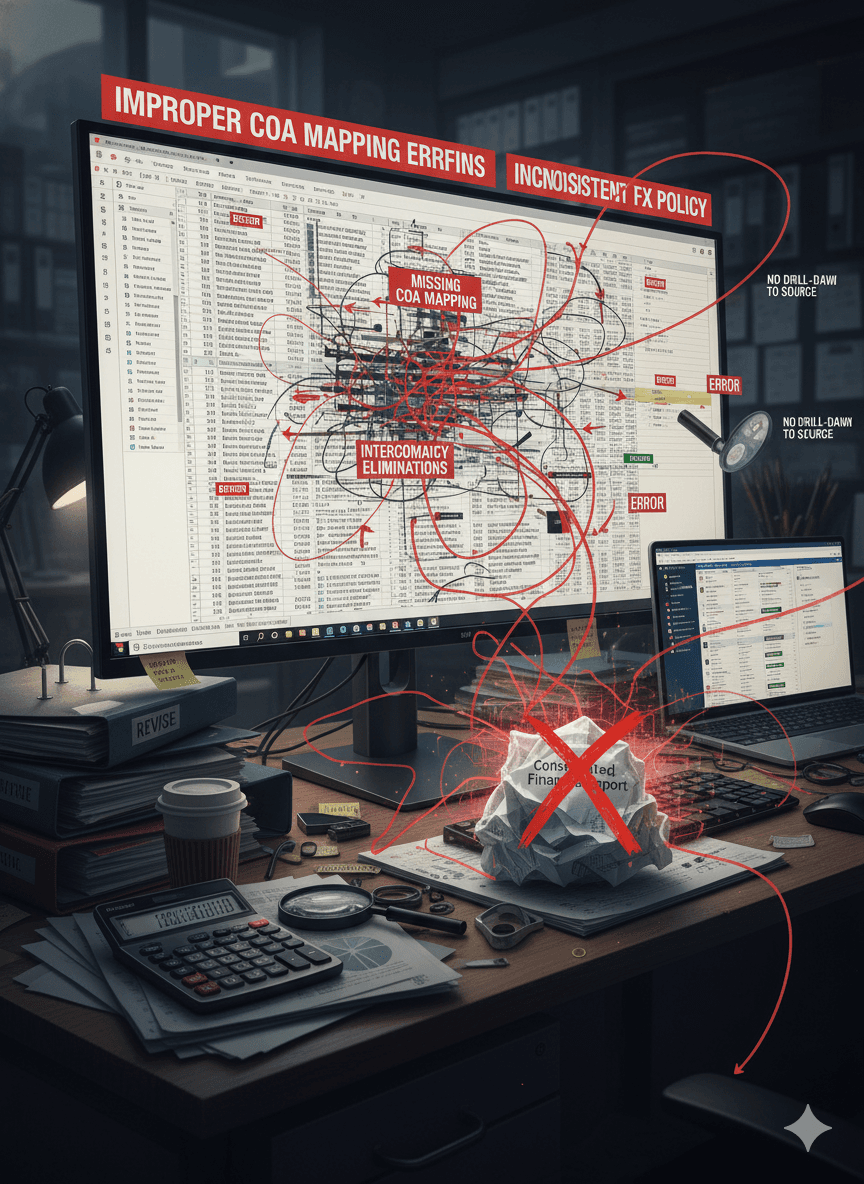

QuickBooks Online excels at entity-level bookkeeping but not at group-level roll-ups. Some of the specific gaps include:

Each entity file in QuickBooks Online is siloed — you cannot natively combine multiple entities into a single P&L/Balance Sheet inside QuickBooks Online.

COAs usually differ between entities (account names, numbers, segment codes), which means standardising is manual and slow.

Intercompany eliminations are not built into QuickBooks Online; finance teams export each entity, build eliminations manually in spreadsheets and lose drill-down traceability.

Foreign-currency translation rules and board-level reporting require additional logic not in QuickBooks Online.

Feature | QuickBooks Online Native | Needed for Consolidation |

Multi-entity roll-up | No | Yes |

COA standardisation | Manual only | Automated mapping |

Intercompany eliminations | None | Yes |

Multi-currency translation | Basic | Policy-based FX |

Drill-down audit trail | Limited | Full trace to source |

The conclusion: if you manage multiple QuickBooks Online entities, you will benefit significantly from a dedicated consolidation tool.

2. What a solid consolidation tool must deliver

When evaluating consolidation software for QuickBooks Online, these six capabilities matter most:

2.1 COA Mapping and Standardisation

A must-have feature: ability to map entity-specific accounts into a unified master chart for roll-up. LiveFlow emphasises this mapping. consolidate.io

2.2 Automated Data Ingestion

Scheduling nightly or live data pulls from each QuickBooks Online file reduces manual work and improves currency of reporting. LiveFlow supports live links. liveflow.com

2.3 Intercompany Eliminations

The tool must support identifying and removing intra-group transactions so consolidated results reflect third-party operations only.

2.4 Multi-Currency Translation

For international entities you need FX rate policy, translation of entity books, and correct presentation in the parent currency. LiveFlow highlights “160+ currencies” support. liveflow.com

2.5 Drill-Down Traceability

Audit-ready structures mean you must be able to trace a consolidated number back to the originating company file and transaction. Fathom reviews highlight drill-down ease. G2

2.6 Scalability and Performance

When you have dozens (or hundreds) of entities the tool must perform at speed and scale. Reviews of high-entity capacity matter. liveflow.com

When a tool meets most of these criteria, you reduce manual risk, cut close-time and improve reporting quality.

3. Tool Review: Evaluating the Top 5 Consolidation Platforms for QuickBooks Online

After analyzing market feedback, practitioner reviews, and integration data, five consolidation tools consistently stand out for QuickBooks Online users. Each solution was evaluated based on integration depth, automation capability, reporting precision, and ease of use.

1. FinBoard.ai — The Controller’s Consolidation Command Center and real time reporting in google sheets

FinBoard.ai has emerged as a preferred consolidation and reporting platform for QuickBooks Online users managing multi-entity or cross-border operations. It integrates directly with QuickBooks Online via secure APIs and supports real-time data sync for multiple subsidiaries.

Key Strengths:

Auto-consolidation across entities with different functional currencies and fiscal calendars.

Built-in eliminations for intercompany transactions with complete audit trails.

Native support for IFRS/GAAP reporting layouts, multi-level hierarchy mapping, and segment reporting.

Advanced analytics using AI-powered variance insights that highlight key drivers behind revenue, expense, or margin shifts.

Use Case:

A mid-market SaaS group operating in the U.S., India, and the U.K. uses FinBoard.ai to automatically consolidate three QuickBooks Online company files, convert GBP/INR results into USD, and generate investor-ready dashboards with minimal manual intervention.Limitation:

Requires initial setup of dimension mapping and chart of accounts alignment to fully leverage its automation layer.

2. LiveFlow

LiveFlow enables finance teams to connect QuickBooks Online data to Google Sheets for dynamic, live-updating dashboards. It simplifies multi-entity reporting by allowing users to pull trial balances and P&L data from various QuickBooks Online files into a single workbook.

Key Strengths:

Direct two-way sync with QuickBooks Online.

Supports consolidated P&L and cash flow reporting.

Familiar spreadsheet interface reduces learning curve.

Use Case:

A growing e-commerce holding company consolidates four QuickBooks Online entities using LiveFlow templates to generate a weekly management report with minimal effort.Limitation:

Complex eliminations or GAAP-compliant adjustments require manual configuration.

3. Fathom

Fathom offers strong visual dashboards and flexible group consolidation tools for QuickBooks Online users. Its drag-and-drop configuration allows quick combination of financial data from multiple entities and real-time performance benchmarking.

Key Strengths:

Multi-entity consolidation with intercompany eliminations.

Custom KPIs and segment benchmarking.

Presentation-quality visual reports ideal for board meetings.

Use Case:

A franchise group with eight QuickBooks Online files uses Fathom to create consolidated dashboards, visual variance reports, and segment comparisons across stores.Limitation:

Consolidations with differing base currencies may require additional configuration.

4. Jirav

Jirav combines consolidation with driver-based forecasting. It is a strong fit for finance teams that need to align actuals from QuickBooks Online with forward-looking budgets and cash projections.

Key Strengths:

Consolidates multi-entity QuickBooks Online data with custom dimensions.

Integrated forecasting, scenario modeling, and headcount planning.

Granular access controls for multi-user environments.

Use Case:

A SaaS company uses Jirav to merge three QuickBooks Online entities, plan headcount growth, and forecast ARR/CAC metrics in a single model.Limitation:

The forecasting module can be overkill for teams seeking only consolidation and reporting.

5. Vena

Vena caters to larger SMBs and mid-market companies that require consolidation with workflow and approval tracking. It connects QuickBooks Online data to a controlled Excel interface backed by a centralized database.

Key Strengths:

Multi-level consolidation with intercompany eliminations and audit trail.

Workflow management for approvals and review.

Excel-based modeling combined with centralized data governance.

Use Case:

A manufacturing group consolidates financials from six QuickBooks Online entities and runs budget versus actual comparisons monthly with full audit visibility.Limitation:

Steeper implementation time compared to lighter tools like LiveFlow or Fathom.

Summary Table: Top Consolidation Tools for QuickBooks Online

Tool | Best For | Key Capabilities | Currency Support | Audit Trail | Pricing Tier |

FinBoard.ai | Multi-entity, cross-currency SaaS firms | Automated eliminations, AI insights, IFRS/GAAP formats | Multi-currency | Full | $ |

LiveFlow | Small teams needing Google Sheets sync | Real-time updates, template-based reporting | Limited | Partial | $$ |

Fathom | Visual dashboard and KPIs | Graphical analysis, benchmarking | Multi-currency | Partial | $$ |

Jirav | Forecasting with consolidation | Driver-based planning, multi-entity merges | Multi-currency | Full | $$$ |

Vena | Enterprise finance controls | Workflow + Excel interface + consolidation | Multi-currency | Full | $$$$ |

4. Choosing the right tool — decision matrix

The optimal tool depends on your size, workflow and audit requirements. Consider:

Workflow preference: Do you use spreadsheets heavily? Choose FinBoard.ai.

Entity count and complexity: <10 entities = spreadsheet tool acceptable. >50 entities, heavy eliminations = Fathom.

Audit and elimination requirements: If you need full audit trail and strong elimination logic pick FinBoard.ai.

Presentation and forecasting needs: If you produce board packs, forecasts, KPI dashboards then Vena.

Decision chart (example fields):

Size | Workflow | Primary Output | Recommended Tool |

Small (1–5 entities) | Spreadsheet-centric | Monthly roll-up | LiveFlow |

Mid (5–20 entities) | Platform + dashboards | Consolidated FS + KPIs | |

Multi-location/Franchise | Benchmarking | Many entities, retail units | |

Advisory/board reporting | Pack-ready output | Investor/board reports | Vena |

Large (>20 entities) | Scale + eliminations + multi-currency | Global corporate group |

5. Implementation checklist & common pitfalls

Checklist

Inventory all QuickBooks Online entities and establish parent entity identifiers

Define and agree master COA and map each entity’s chart into it

Setup scheduled data pull or connector from each QuickBooks Online file

Configure elimination rules (inter-company accounts, parent-child flows)

Define foreign-currency translation policy and rates for reporting entity

Pilot with 2–3 entities, test mapping, reconciliation and drill-down workflows

Document the process for auditors (mapping tables, elimination logic, FX policy)

Deploy across all entities, automate refresh schedule and month-end reconciliation

Train users, review initial results, adjust mapping and processes based on lessons

Mini-Case

Scenario:

A parent company holds five subsidiaries running on QuickBooks Online: US (USD), UK (GBP), India (INR), Canada (CAD) and Australia (AUD). Each entity uses a different COA layout. Inter-company loans and internal service charges are flowing between them. The finance team must produce a consolidated monthly P&L/Balance Sheet in USD and an audit-friendly drilldown from group line items to entity journal entries.

Challenge:

Manual consolidation (export to Excel) took 4 days each month. Mapping differences, currency translation and inter-company entries created recurring errors. Auditors asked for traceability and time was consumed reconciling intra-group balances.

Solution:

They selected FinBoard.ai due to its elimination engine, multi-currency support and visual dashboards. Implementation steps:

Mapped each entity’s COA to master parent COA inside Syft.

Configured inter-company account rules (loans and service recharge).

Set translation policy: month-end USD rate for all foreign entities.

Created consolidated statements and drill-down links to each entity QuickBooks Online file.

Conducted pilot with 2 entities and reconciled totals; full roll-out next month.

Outcome:

Month-end close time reduced from 4 days to 1.

Consolidated P&L and Balance Sheet produced by day 3 with audit-ready drill-down.

Eliminated double counting of internal service charges, improved accuracy of consolidated net income.

Board received automatically generated dashboards with group performance KPIs and eliminated inter-company flows.

Key takeaway:

Using the right consolidation tool transformed a labour-intensive manual close into a streamlined, auditable process, allowing the finance team to shift focus from assembling numbers to analysing performance.

Risks & Mitigations

Risk: Mapping errors misclassify accounts in consolidated results.

Mitigation: Review and test mapping tables; reconcile to entity GLs each close.Risk: Inter-company flows left un-eliminated inflate income or assets.

Mitigation: Use tool elimination logic; include internal controls and review.Risk: FX translation inconsistencies across entities.

Mitigation: Define and document a single group FX policy and apply consistently.Risk: Over-reliance on spreadsheets without traceability for audit.

Mitigation: Select a tool offering drill-down traceability; maintain an audit trail.

FAQ

1. Does QuickBooks Online support multi-entity consolidation natively?

No. QuickBooks Online lacks true multi-entity consolidation capabilities; third-party tools are required for full group roll-up. FinBoard.ai

2. Which tool is fastest to implement for spreadsheet-centric teams?

FinBoard.ai — because it connects to QuickBooks Online and integrates with Google Sheets/Excel, enabling finance teams comfortable with spreadsheets to consolidate quickly.

3. If we need strong elimination workflows and global currency support, which tool is best?

FinBoard.ai provides flexible elimination rules, and supports consolidation across many currencies and entities.

4. How many entities can these consolidation tools handle?

It varies by tool and plan. For example, FinBoard.ai lists capability for hundreds of entities; scale and performance should be tested if you have large entity counts.

Glossary

Consolidation: The process of combining financial statements of multiple entities into a single group report.

Chart of Accounts (COA) mapping: Aligning each entity’s account structure to a unified master template for group roll-up.

Inter-company eliminations: Removing transactions between entities (e.g., internal service charges, loans) so group results only reflect external activity.

Foreign-currency translation: Converting entity financials into a single reporting currency using defined FX rates and policies.

Drill-down: The ability to trace group-level numbers back to source transactions in each entity’s books.