CECL is not about predicting defaults perfectly. It is about documenting reasonable expectations.

QuickBooks Online contains the raw data needed for CECL, but not the model.

Most SaaS companies should use vintage or loss-rate methods, not complex PD models.

The biggest CECL risks are undocumented assumptions and spreadsheet drift.

FinBoard.ai quietly solves data lineage and repeatability without replacing judgment.

Executive Summary

CECL is one of those accounting standards that looks intimidating on paper but becomes manageable once you understand what it actually expects from management. It does not ask you to forecast the future with precision. It asks you to think honestly about how your customers behave over time and reflect that expectation in your financial statements. For companies using QuickBooks Online, the challenge is rarely conceptual. It is operational. The data exists, but it is scattered across invoices, payments, credit memos, and write-offs. The modeling happens in Excel, often built by someone who leaves the company a year later. Auditors do not challenge the math first. They challenge the logic, consistency, and documentation. This article walks through how SaaS and SMB finance teams can design a lifetime expected credit loss model using QuickBooks Online data, why vintage analysis works well in subscription businesses, and where teams get into trouble as they scale. Along the way, it shows how FinBoard.ai fits naturally into this workflow by stabilizing data, preserving assumptions, and reducing rework without turning CECL into a black box.

1. Why CECL Requires Lifetime Modeling (And Why That Matters)

Before CECL, most companies lived comfortably under an incurred loss mindset. You waited until something went wrong. A customer stopped paying. An invoice crossed 120 days. A dispute escalated. Only then did you record a bad debt.

CECL flips that logic.

The allowance must reflect expected losses over the entire contractual life of the receivable. That means the moment a SaaS company issues an invoice, it must ask: Based on what we know today, how much of this amount will we never collect?

For subscription businesses, this is not theoretical. It is lived experience. Customers churn mid-term. Startups run out of funding. Procurement delays payments indefinitely. Support disputes turn into credits. These outcomes do not happen evenly across time. They cluster.

QuickBooks Online captures all of this eventually. But CECL requires management to connect those dots earlier.

2. CECL Is Judgment-Heavy by Design (And That Is Not a Bad Thing)

A common misconception is that CECL demands sophisticated financial modeling. In reality, the standard is intentionally principle-based. It does not mandate probability of default curves or Monte Carlo simulations.

That flexibility is a blessing for SMBs. It allows companies using QuickBooks Online to build models that fit their size, data availability, and risk profile.

The danger comes when flexibility turns into informality.

Auditors rarely reject a CECL model because it is too simple. They reject it because:

The method changes quarter to quarter

Assumptions are undocumented

Adjustments are not tied to evidence

The data source is unclear

3. Choosing the Right CECL Method for QuickBooks Online Users

Let us talk about method selection, because this is where many teams overthink.

Why PD × LGD Usually Fails for SaaS SMBs

Probability of default models sound sophisticated. They also require:

Credit scoring data

Contractual maturity schedules

Default definitions aligned with lending

Most SaaS receivables are short-term and non-interest bearing. Customers default in messy, operational ways. PD models rarely improve accuracy and often reduce audit clarity.

Why Loss-Rate and Vintage Models Work Better

Loss-rate models look at historical write-offs as a percentage of receivables. They are simple and effective for stable customer bases.

Vintage models go one step further. They track how receivables behave over time, grouped by origination period. For SaaS companies billing monthly or annually, this aligns beautifully with subscription cohorts.

Auditors like vintage models because:

They reflect customer behavior patterns

They highlight seasonality and churn effects

They are intuitive to review

4. The Reality of QuickBooks Online Data (What You Get and What You Do Not)

QuickBooks Online is a transactional system. It is excellent at recording what happened. It is not designed to answer analytical questions like lifetime loss.

What QuickBooks Online does well:

Invoice-level detail

Payment application history

Credit memos and write-offs

Customer segmentation

What QuickBooks Online does not do:

Create origination cohorts

Track lifetime outcomes by vintage

Store CECL assumptions

Preserve historical model versions

This is why CECL models live outside QuickBooks Online. The key is making sure they stay connected to QuickBooks Online data.

5. Extracting the Right Data Without Breaking Your Sanity

Most teams start the same way. They export:

Open AR aging

Invoice detail reports

Write-off summaries

They merge these into Excel. They build formulas. It works.

Until it does not.

Common failure points:

Someone overwrites a column

A report filter changes

A new customer segment is added

Prior-period models cannot be reconstructed

FinBoard.ai addresses this quietly by stabilizing data extraction. It does not change the accounting logic. It ensures the same data arrives the same way every period.

6. Building the Lifetime Loss Model (The Part Everyone Overthinks)

Let us slow this down.

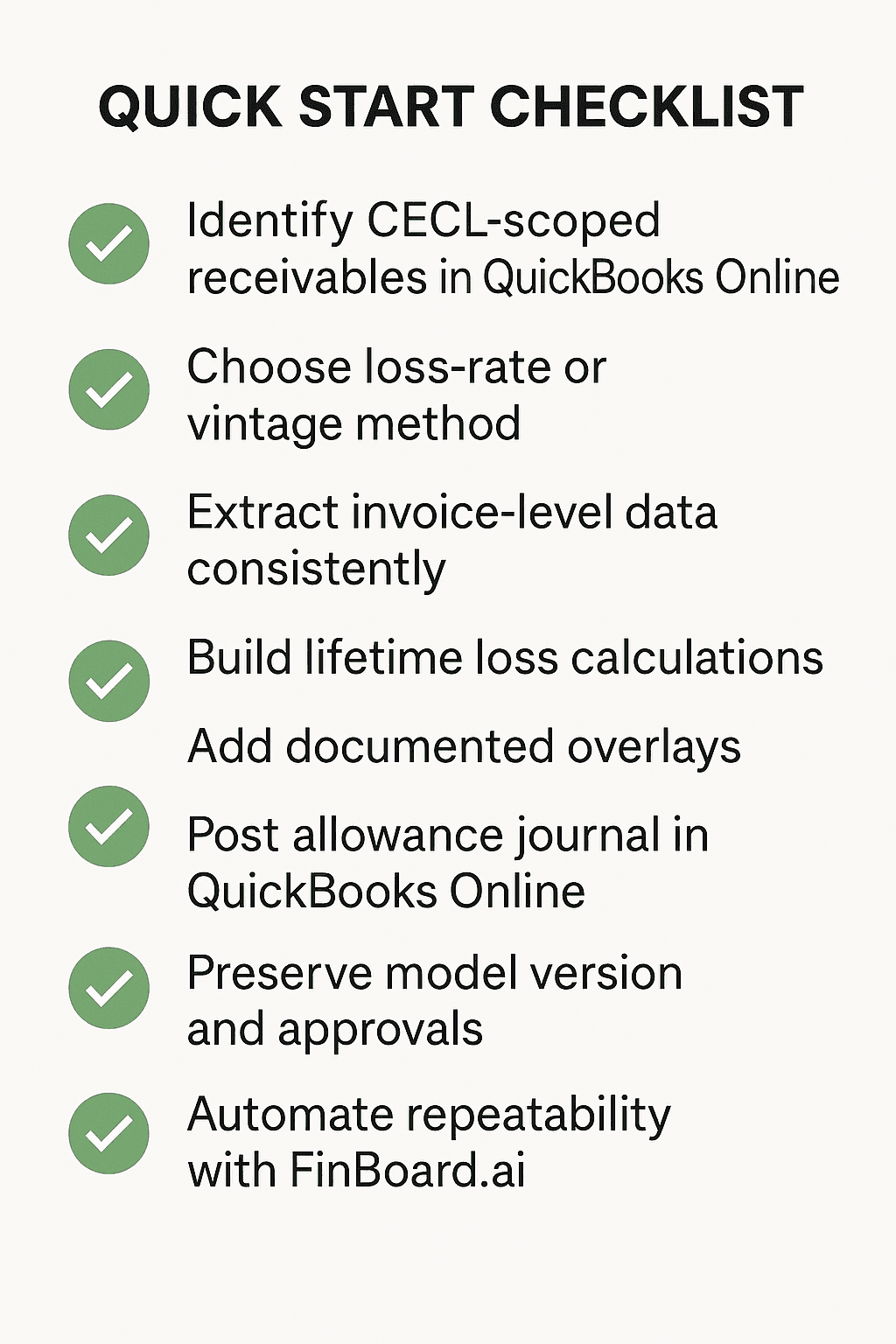

Step 1: Define the population

Decide which receivables fall under CECL. For most SaaS companies, this is trade receivables from customers.

Exclude:

Deposits

Related-party balances

Non-contractual receivables

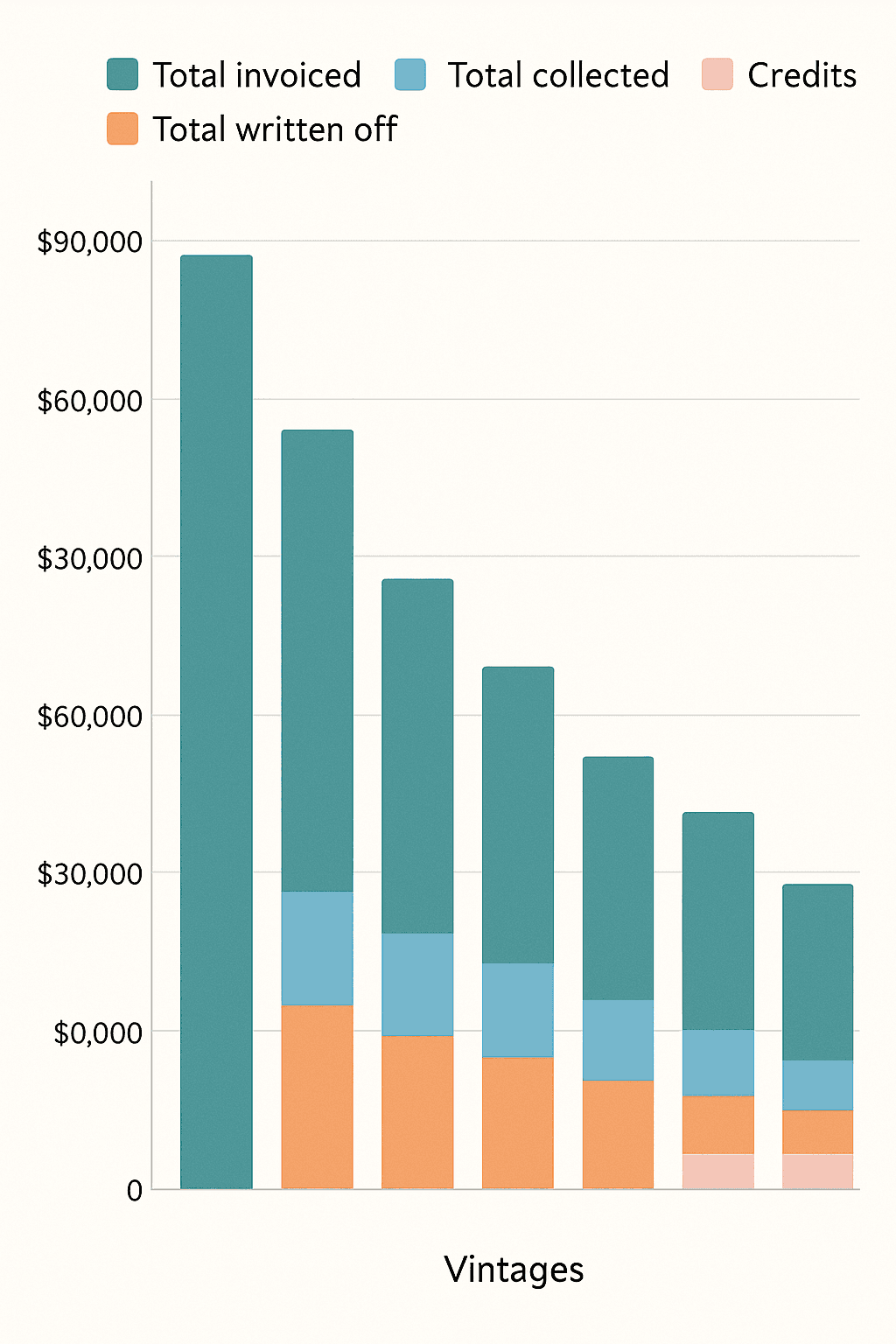

Step 2: Create vintages

Group invoices by origination month or quarter. Annual billing SaaS companies often use invoice date. Monthly billing companies sometimes use subscription start date.

Consistency matters more than perfection.

Step 3: Track outcomes

For each vintage:

Total invoiced

Total collected

Total written off

Credits issued

This shows how losses emerge over time.

Step 4: Calculate lifetime loss rates

Loss rate = total losses ÷ total invoiced for the vintage.

Apply those rates to current outstanding balances from similar vintages.

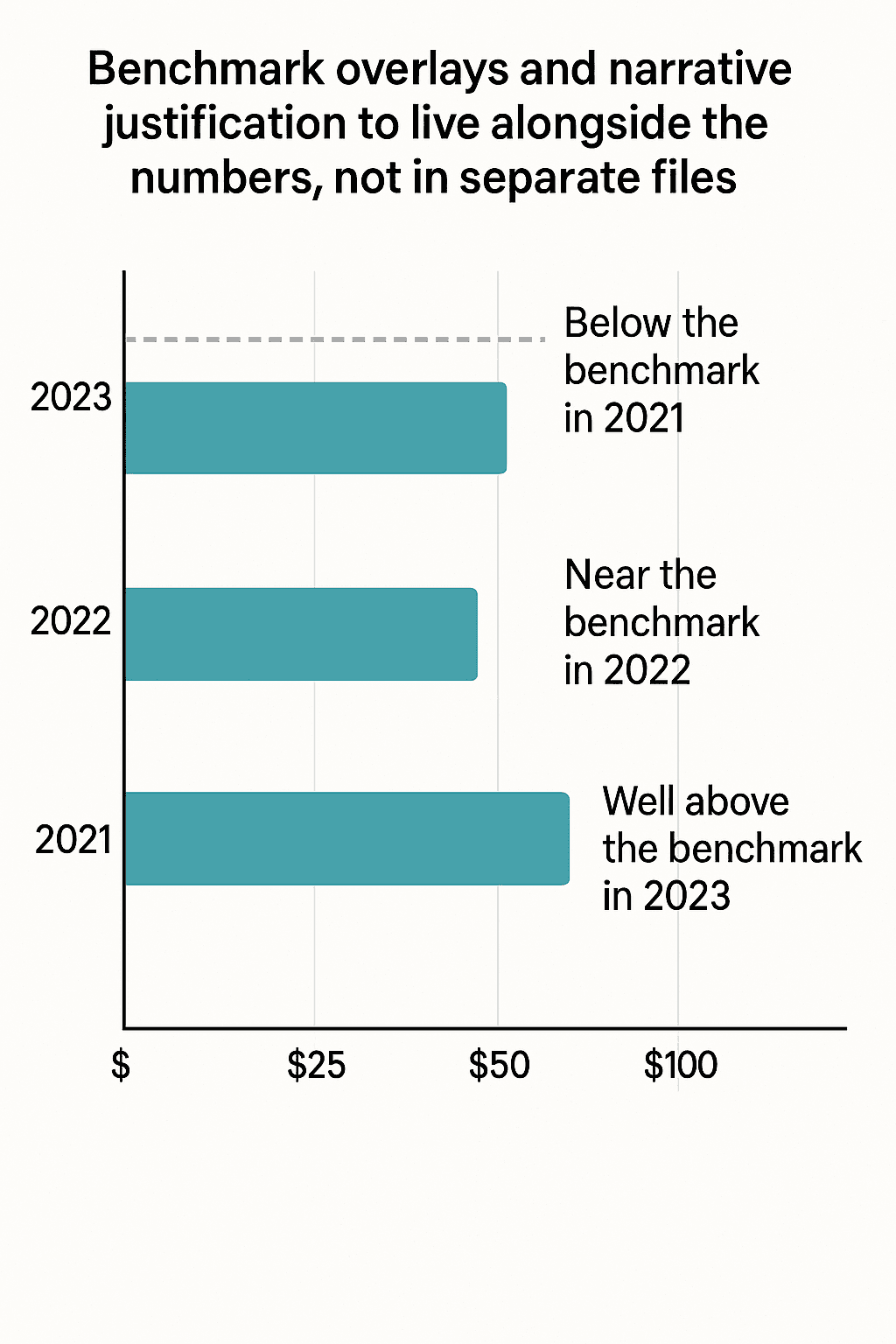

7. What Happens When History Is Limited (And It Usually Is)

Many SaaS companies only have two or three years of data. CECL does not require perfection. It requires reasonable estimates.

Common approaches:

Use pooled historical data

Supplement with peer benchmarks

Apply management overlays

The mistake is pretending limited data does not exist. Auditors are comfortable with judgment. They are uncomfortable with silence.

8. Forward-Looking Adjustments: Where CECL Gets Political

This is the part no one enjoys.

Forward-looking adjustments require management to say out loud:

We expect churn to increase

Customer quality has declined

Economic conditions are tightening

These statements often come from sales or leadership discussions, not accounting systems.

The adjustment itself is less important than:

Why it exists

How it was quantified

Who approved it

This is where spreadsheets usually fail. The number exists. The story disappears.

9. Governance, Controls, and Why Excel Eventually Breaks

Excel is not evil. It is fragile.

As CECL models mature, teams struggle with:

Version control

Prior-period reconstruction

Reviewer sign-off

Audit requests six months later

FinBoard.ai does not replace Excel thinking. It wraps it with controls. Data flows in. Assumptions are locked. Versions are preserved. Review notes are attached.

This is how CECL becomes sustainable instead of stressful.

Mini-Case: SaaS Company Scaling Past $10M ARR

A SaaS company using QuickBooks Online grew from $3M to $12M ARR in two years. Initially, CECL was a flat 1 percent allowance. As churn increased, auditors challenged the static rate. The company implemented a vintage model using QuickBooks Online invoice data. Losses clustered in certain cohorts tied to aggressive sales periods. Management added a forward-looking overlay for new customers. FinBoard.ai automated monthly data pulls and preserved quarterly assumptions. The audit passed without adjustments.

Risks and Mitigations

Risk | Mitigation |

Overly simplistic model | Add segmentation and overlays |

Undocumented assumptions | Store narratives with numbers |

Data inconsistency | Automate extraction |

Audit reconstruction issues | Preserve versions |

FAQ

Does CECL require changing prior periods?

No. CECL is a point-in-time estimate updated prospectively.

Can auditors reject management judgment?

They challenge support, not opinion.

Is FinBoard.ai required for CECL?

No. It reduces operational risk as complexity grows.

How often should assumptions change?

Only when facts change.

Glossary

CECL: Expected lifetime credit loss model under ASC 326

Vintage: Grouping receivables by origination period

Overlay: Qualitative adjustment

Allowance: Contra asset for expected losses

Data lineage: Traceability from source to report