FinBoard.ai vs. Fathom: The Ultimate QuickBooks Online Reporting Showdown

Thinking about stepping up your QuickBooks Online reporting game but torn between Fathom and FinBoard.ai? You’re not alone. Both tools are popular among finance teams, accountants, and business owners looking to simplify reporting, automate data pulls, and turn complex numbers into insights that drive better decisions.

Let’s break it down — the similarities, the differences, and what really matters when you’re choosing the right reporting platform for your workflow. We’ll walk through integrations, features, user experience, support, and real-world usability — so you can confidently decide which one fits your business best.

What Sets Fathom and FinBoard.ai Apart?

Before diving deep into the technicalities, it helps to understand where each platform comes from and what they’re trying to achieve.

At its core, Fathom is a robust data connector and visualization tool that integrates with popular accounting systems like QuickBooks Online, Xero, MYOB, and Access Financials. It helps users analyze key metrics, visualize financial performance, and generate customized dashboards with powerful charts and graphs. Fathom is known for its in-platform reporting and forecasting capabilities — ideal for teams that want an all-in-one analytics environment.

However, it operates entirely on its own proprietary cloud platform and doesn’t natively sync with Google Sheets or Microsoft Excel. So, if you want to manipulate or customize data in spreadsheets, you’ll need to export your reports manually — a process that can become repetitive and time-consuming, especially if you update your numbers frequently.

With over 100 pre-built templates, real-time synchronization, multi-entity consolidation, and customizable financial models, FinBoard.ai transforms ordinary spreadsheets into dynamic, automated dashboards that update as your QuickBooks Online data changes. No manual exports, no version confusion, and no waiting.

So, while Fathom offers an excellent standalone analytics platform, FinBoard.ai integrates directly into your daily workflow. Let’s see how that difference plays out.

Integration Capabilities

When it comes to integration, the biggest question is: How easily can your accounting data flow into your reporting system?

Fathom connects with major accounting tools — QuickBooks Online, Xero, MYOB, and Access Financials. This flexibility makes it appealing for accountants managing clients across multiple systems. However, the trade-off is that it only updates within its own ecosystem. If your workflow lives in spreadsheets or you collaborate using Google Sheets, you’ll have to manually export and re-import data.

That’s where FinBoard.ai truly shines. Its integration focuses exclusively on QuickBooks Online, meaning it’s optimized to handle the nuances of QuickBooks Online data structures, chart of accounts, and real-time syncs. You simply connect QuickBooks Online once, and your data automatically flows into your chosen spreadsheet — no manual refresh required.

If you don’t use QuickBooks Online yet, FinBoard.ai won’t be a match right now. But for QuickBooks Online users, it’s a complete game-changer. And for those wondering — yes, a Xero integration is already in the works.

So, while Fathom’s versatility makes it great for multi-software ecosystems, FinBoard.ai’s laser focus gives QuickBooks Online users a smoother, faster, and cleaner integration experience.

Key Features: What You Actually Get

Let’s break down what each platform brings to the table.

Fathom’s Key Features

Advanced Financial Analysis: Fathom helps you dig into profitability, cash flow, and performance metrics with a broad range of analytical tools.

Customizable Dashboards: Build tailored dashboards featuring KPIs, trend graphs, and visual scorecards to track business performance.

Multi-Entity Consolidation: Merge financials from multiple companies into one unified view — ideal for groups or franchises.

Forecasting and Budgeting: Use built-in forecasting tools to model different business scenarios and track budget vs. actual performance.

Fathom’s interface is sleek and full of visuals, giving you charts and graphs that make financial storytelling easy. However, all of this happens within its own closed environment. If you or your team prefer working directly in spreadsheets, you’ll find this setup restrictive.

FinBoard.ai’s Key Features

FinBoard.ai, on the other hand, embraces the spreadsheet. It doesn’t ask you to learn a new interface — instead, it brings automation, live data, and collaboration directly into Google Sheets or Excel.

Live Data Sync: Automatically pulls real-time QuickBooks Online data into your spreadsheet — no manual exports, ever.

Instant Consolidation: Consolidate multiple entities in under three minutes, with automatic updates whenever underlying data changes.

Transaction-Level Drilldown: Click any number to see the underlying transactions — without leaving your spreadsheet.

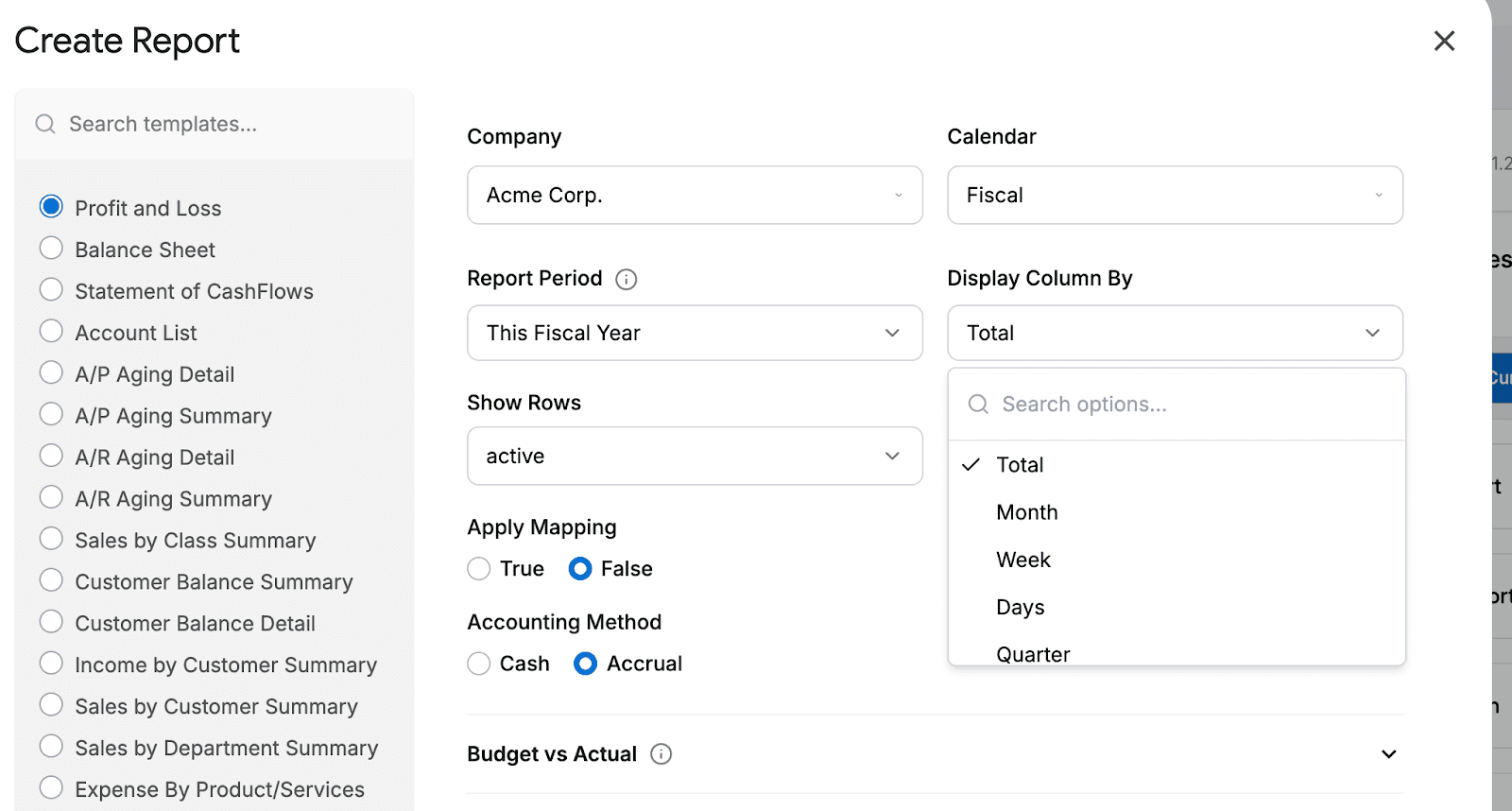

100+ Prebuilt Templates: From cash flow dashboards to P&L summaries and balance sheets, you can customize professional reports instantly.

Enterprise-Grade Security: Built with SOC-2 level compliance to protect sensitive financial data.

Dedicated Customer Success Team: Get hands-on onboarding and real-time support from finance professionals.

FinBoard.ai essentially turns your Google Sheets into a live reporting hub. Instead of working around spreadsheets, it works with them — which makes a huge difference for teams that already depend on Sheets or Excel as their daily workspace.

User Experience and Accessibility

Fathom is polished, but it’s built for power users. Its interface emphasizes charts, graphs, and visual analysis — which look great but can take some time to master. If you’re a controller, FP&A analyst, or CFO, you’ll appreciate its analytical depth. However, onboarding can feel steep for team members who aren’t used to advanced financial visualization platforms.

FinBoard.ai, in contrast, focuses on simplicity and familiarity. If you’ve ever built a pivot table or chart in Google Sheets, you’re already most of the way there. You log in, connect QuickBooks Online, pick a template, and your reports populate instantly. Everything stays within the same spreadsheet you already know — just with automated data flows.

This low learning curve makes FinBoard.ai ideal for small and mid-sized businesses, accountants, and finance teams who want to spend time analyzing, not configuring. In short: if you can use a spreadsheet, you can use FinBoard.ai.

Customer Success: Where FinBoard.ai Really Wins

This is where the difference becomes crystal clear.

FinBoard.ai’s Customer Success Team is staffed by professionals with finance and accounting backgrounds. From your very first demo, you get hands-on guidance through setup, onboarding, and custom report creation. Whether it’s over Slack, email, or direct Intercom chat, you always have someone available who speaks your language — and understands your reporting challenges.

They even offer white-labeled model creation, meaning they can help design branded dashboards and reports tailored to your organization’s look and feel. This level of service is rarely seen in SaaS financial tools, and it significantly reduces ramp-up time.

Fathom, on the other hand, offers support mainly through documentation and help tickets. While it’s functional, response times can take a few days, and users often describe the experience as impersonal. For teams looking for personalized, responsive guidance, this can be a dealbreaker.

If exceptional support and an invested partner matter to you, FinBoard.ai stands out — no contest.

Performance and Efficiency

Both tools deliver automation, but their approaches to efficiency differ.

Fathom automates report generation and visualization once you’ve imported your data. You’ll still need to refresh periodically or re-import data when making updates. For many teams, this is manageable — but it adds friction over time.

FinBoard.ai, however, runs live syncs in the background. When a transaction, invoice, or adjustment happens in QuickBooks Online, it updates instantly in your spreadsheet. That’s a huge advantage during busy close cycles, when you need real-time numbers.

Customers report saving an average of 192 hours per year on manual reporting and data prep. That’s nearly five full workweeks — time that can now be spent on strategy, analysis, or growing your business.

Pricing Transparency

While Fathom’s pricing depends on factors like the number of companies or users, it typically sits at a mid-range point in the FP&A market. However, the lack of native spreadsheet integration means you might also be spending more time on exports and formatting — a hidden cost in the long run.

FinBoard.ai follows a transparent pricing model, scaling with the size of your business and your reporting needs. Because it replaces so much manual work, the ROI becomes visible within weeks. Customers often find that what they save in hours and labor far outweighs the subscription cost.

In short: Fathom charges for access. FinBoard.ai delivers ongoing value.

The Verdict: Which One Should You Choose?

When deciding between Fathom and FinBoard.ai, the right answer depends on what kind of reporting experience you want.

If you manage multiple accounting systems (QuickBooks Online, Xero, MYOB) and prefer a visually rich, standalone platform for deep analysis, Fathom is a solid choice.

If your business runs entirely on QuickBooks Online and your team already works in Google Sheets or Excel, then FinBoard.ai is tailor-made for you.

FinBoard.ai gives you real-time automation, instant consolidation, and unmatched support, all inside the spreadsheet tools you already use every day. No new software to learn. No data silos. Just faster, cleaner reporting — and more time to focus on insights that actually matter.

So ask yourself:

Do you want speed, automation, and flexibility inside your existing tools?

Do you need a partner who offers live human support and custom model setup?

Do you rely heavily on QuickBooks Online data?

If the answer to those is yes, then the choice is clear — FinBoard.ai is the smarter, faster, and more practical solution.

Quick Start Checklist

Final Thoughts

Both Fathom and FinBoard.ai have their strengths. Fathom offers breadth across multiple accounting systems and visually rich analysis. FinBoard.ai offers depth, automation, and flexibility within spreadsheets — the place where most finance teams already live.

At the end of the day, software should fit your workflow, not the other way around. If your team is already collaborating in Google Sheets or Excel and you rely on QuickBooks Online, FinBoard.ai delivers the seamless integration, real-time reporting, and personalized support you’ve been looking for.

Book a Demo

See for yourself why more QuickBooks Online users are switching to FinBoard.ai.

Book a free demo today and experience firsthand how FinBoard.ai can save your team up to 192 hours a year on reporting tasks — while giving you confidence that your numbers are always up to date.