Executive summary

Small and mid-market groups frequently rely on QuickBooks Online for bookkeeping. QuickBooks Online handles bank reconciliation per company file but does not give a consolidated bank-reconciliation or a group cash position. Timing differences — intercompany transfers posted on different dates, deposits in transit, delayed processor settlements, and differing month-end cutoffs — are the main reason consolidated cash flow reports fail or show misleading numbers. The practical approach is threefold: detect anomalies early with targeted reports; normalise posting and use cash-in-transit accounts; centralise elimination logic in a consolidation tool or a controlled workbook. Where the group is larger or lenders require audited consolidated cash flows, add a consolidation app that supports intercompany eliminations and audit logging.

1) Why timing differences matter to consolidated cash flow

Consolidated cash flow must represent the group cash movement within the reporting period. A single intercompany transfer recorded by one subsidiary on Day 1 and recorded by the receiving subsidiary on Day 3 will show as a cash outflow and inflow in different periods if left unaligned. That noise obscures operating cash trends and liquidity. Commonly observed examples include ACH delays, week-end bank posting differences, processor settlements, and unapplied receipts. Each creates timing noise that disrupts consolidated flow.

2) How QuickBooks Online’s reconciliation model exposes the problem

QuickBooks Online reconciles accounts file-by-file. The reconciliation process compares your register to the bank statement and resolves outstanding items. This works for single-entity reporting, but it leaves three gaps for multi-entity consolidation:

No group reconciliation view to show intercompany matches across files.

Register vs statement balance differences are a frequent source of confusion; these differences multiply when aggregating files.

Bank feed matching and auto-rules run per file and on different cadences; that asymmetry creates artificial timing gaps.

The net result is an apparently reconciled set of entity accounts that nonetheless fail to tie when you build consolidated cash flow.

3) Top practical causes of timing noise (with short diagnosis)

Intercompany transfers — recorded on different posting dates; fix with an intercompany register and tag entries.

Deposits in transit — bank clears later than entity records; use cash-in-transit account lines.

ACH/wire settlement lags — banks have different posting cutoffs and may show a different settlement date than the originating entity.

Card processor timing & chargebacks — merchant deposits hit bank on scheduled cycles; track processor reports separately.

Payroll recharges and shared services — recharges posted after payroll funding; establish recharge cycles.

Detecting the root cause often requires cross-file transaction matching and a clear intercompany taxonomy.

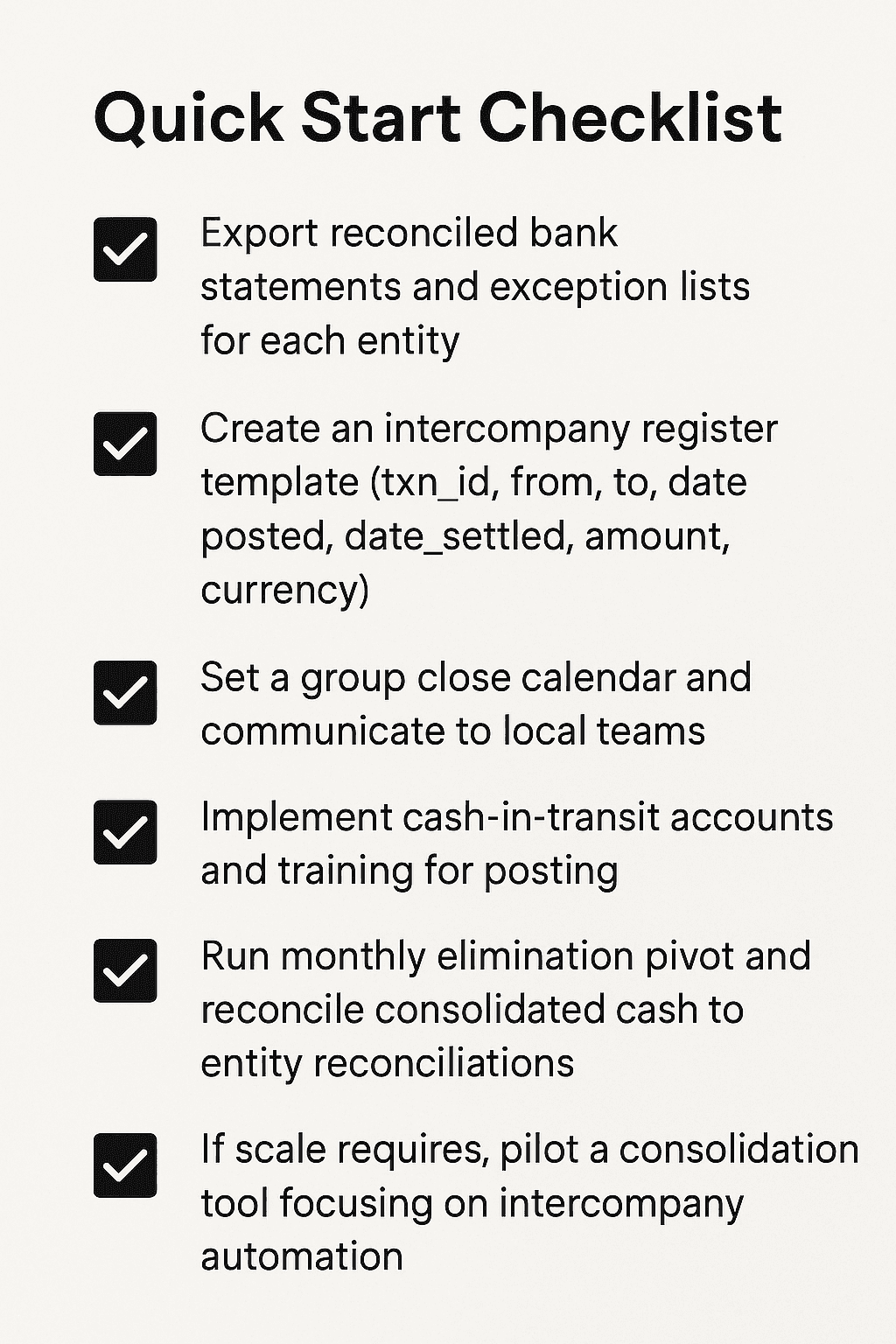

4) A step-by-step detection and remediation playbook

Detect

Run per-entity bank reconciliation reports and export reconciliation exception lists.

Build an intercompany activity report: filter AR/AP, transfers, and clearing accounts for cross-entity counterparties.

Compare bank settlement dates vs posting dates using bank feed exports. Look for gaps greater than your group threshold (e.g., 48 hours).

Remediate

Use cash-in-transit (CIT) accounts. When entity A sends to entity B, post the outgoing to CIT and the incoming to CIT until settlement. At consolidation, eliminate CIT across entities. This avoids period mismatches.(CIT = Cash in transit)

Standardise posting rules and close calendars. Agree group cutoff (e.g., bank posting as-of date) and enforce it in the close checklist.

Maintain an intercompany register. Key fields: txn_id, entity_from, entity_to, amount, currency, bank_settlement_date, entity_post_date, elimination_flag. Use this as the single source of truth for elimination entries.

Automate eliminations where possible. Map intercompany accounts in a consolidation tool to remove matched flows automatically. Manual JEs should be rare and documented. Finboard.ai helps users automate their eliminations at one click.

Reconciliation note: After applying eliminations, tie consolidated closing cash to the sum of reconciled entity closing cash less intercompany. Store signed PDFs for each entity recon as audit evidence.

6) Mini-case: quick example

Case Study 1 – Mid-Market SaaS: Cross-Border Cash Flow Timing Gaps (US + India)

Background

CloudPilot, a mid-market SaaS company based in San Francisco, provides subscription-based workflow automation tools. To control costs and accelerate development, CloudPilot operates a wholly owned subsidiary in Bengaluru, India, which handles engineering and product delivery. Both entities run on QuickBooks Online. The parent company bills customers in USD and funds the subsidiary through intercompany payments.

Challenge

CloudPilot’s finance team struggled with persistent cash flow timing differences between the US parent and Indian subsidiary. The parent recorded intercompany transfers on the day funds left its US bank account. However, delays in foreign exchange settlement meant the Indian entity received INR equivalents 2–3 days later. The Indian books reflected the inflow only upon deposit, creating mismatches in consolidated cash flow statements.

The problem extended beyond intercompany transfers. Subscription revenue collected from US clients was often pooled and remitted monthly to India. QuickBooks Online lacked tools to align these flows across entities or track them as a single economic transaction.

Manual Solution – Case Study 1: Mid-Market SaaS (US + India)

Objective:

Resolve timing mismatches in cross-border cash flow between the US parent and Indian subsidiary, and improve visibility into consolidated liquidity — without any third-party automation tools.

Step 1 – Create a Standardized Transaction Timeline Template

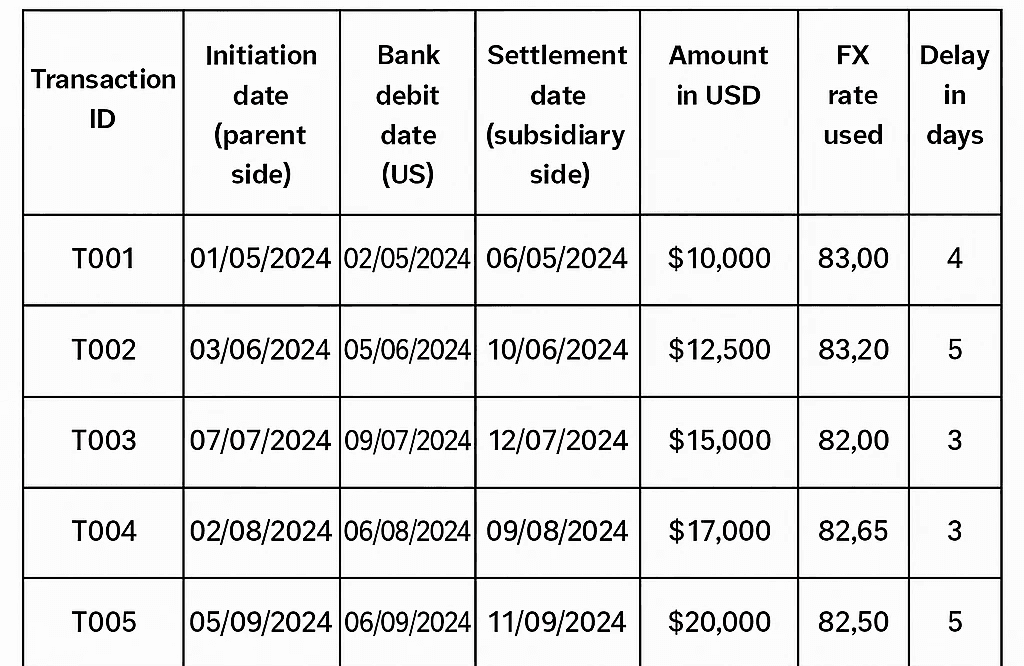

The first step is to implement a shared Google Sheet that acts as a cash movement timeline for intercompany transfers and revenue remittances. The template should have at least the following columns:

Each intercompany payment and revenue remittance is logged into this sheet as soon as it is initiated. The US team fills in the initiation date and USD amount when cash leaves the US account. The Indian finance team updates the settlement date and INR equivalent once funds are credited locally.

Step 2 – Align Intercompany Journals Using Memo Accounts

QuickBooks Online does not inherently match transactions across entities, but the finance team can introduce memo accounts to temporarily hold cross-border payments.

Example journal entry in the US parent books on initiation date:

Date | Account | Debit | Credit |

01-Feb | Intercompany Receivable – India | $100,000 | |

01-Feb | Bank | $100,000 |

Journal entry in the Indian books on settlement date:

Date | Account | Debit | Credit |

04-Feb | Bank | ₹8,200,000 | |

04-Feb | Intercompany Payable – US | ₹8,200,000 |

By maintaining these memo accounts, the team can reconcile the difference between initiation and settlement dates without forcing immediate elimination entries. Timing differences are visible directly from the ledger.

Step 3 – Month-End Timing Difference Reconciliation

At month-end, the shared sheet is filtered for transactions where initiation and settlement dates fall into different months. These represent timing differences that must be explained in the consolidated cash flow.

The team then prepares a manual timing difference schedule as part of the consolidation pack:

Transaction | Amount (USD) | Initiated | Settled | Difference Days | Explanation |

IC-24-021 | $100,000 | 29-Jan | 02-Feb | 4 days | FX settlement delay |

IC-24-022 | $75,000 | 15-Feb | 16-Feb | 1 day | Weekend delay |

This schedule is used to reconcile discrepancies between QuickBooks cash flow reports and actual bank activity.

Step 4 – Reporting Adjustments

In the consolidated cash flow statement, the finance team manually reclassifies timing differences. For example, if $100,000 was initiated in January but settled in February, it is included as an adjustment line item in January’s reconciliation notes, clarifying that the transaction did not settle until the next period.

Solution with Finbaord.ai

CloudPilot implemented FinBoard.ai connected to both entities’ QuickBooks Online accounts and layered Google Sheets for reconciliation workflows. The team configured FinBoard.ai to capture both the transaction initiation date (US side) and the settlement date (India side) for each intercompany cash flow. It then applied tagging rules to pair related transactions across books, even when currencies or dates differed.

FinBoard.ai’s cash flow engine adjusted consolidated reporting to reflect transaction timing consistently. Intercompany transfers now appeared as a single paired entry with a clear settlement timeline. The Google Sheets connector pulled paired data into a reconciliation tracker that highlighted unmatched transactions and aging delays in real time.

Case Study 2 – Complex Global SaaS Group: Multi-Currency Timing Differences and Cross-Entity Reconciliation

Background

NovaCore, a global SaaS platform headquartered in Boston, operates four subsidiaries: NovaCore UK (London), NovaCore India (Hyderabad), NovaCore Singapore, and NovaCore US. The company bills enterprise clients across North America, Europe, and Asia in USD, GBP, EUR, and INR. Each entity uses QuickBooks Online locally, but the group reports consolidated financials to investors quarterly.

NovaCore manages liquidity centrally. Cash from client payments is collected in multiple currencies and routed through a cash pooling arrangement in Singapore. From there, funds are redistributed to regional entities based on working capital needs. Each entity also invoices others for shared services, such as engineering and marketing, creating frequent intercompany transactions.

Challenge

NovaCore’s consolidated cash flow reporting and cross-entity bank reconciliation were consistently inaccurate and delayed. Multiple layers of timing differences were at play:

FX Settlement Lags: Payments from European clients in EUR often took three to five days to convert and post in USD in the Singapore pool. QuickBooks captured these as separate events, breaking transaction continuity.

Staggered Intercompany Flows: The UK subsidiary invoiced the US parent monthly for support services. Payments left the US bank on the last day of the month but appeared in the UK books the following month due to cross-border settlement delays.

Cash Pool Movements: Cash consolidated in Singapore was redistributed to India and the UK on a weekly basis. QuickBooks treated these as unrelated deposits and withdrawals rather than internal transfers tied to a central pool.

Customer Refunds: Refunds processed in local currencies created additional timing mismatches, as they were often initiated centrally but recorded locally.

With no native way to unify these timing layers, the finance team resorted to manually exporting bank feeds, transaction lists, and intercompany ledgers from four QuickBooks instances into Excel. The reconciliation workbook exceeded 20,000 rows each quarter. Errors were frequent, matching logic was inconsistent, and audit documentation was scattered.

Manual Solution – Case Study 2: Global SaaS Group (4+ Currencies)

Objective:

Handle complex multi-currency cash flow timing differences and reconcile cross-entity transactions manually, without automation.

Step 1 – Build a Master Multi-Currency Reconciliation Workbook

A robust multi-sheet Excel workbook becomes the central tool for all cash movements. Key worksheets include:

Customer Collections Sheet – logs every client payment with date received, currency, converted USD amount, and settlement date into the Singapore pool.

FX Conversion Log – tracks foreign exchange deals, with original amount, converted amount, rate, and settlement lag.

Intercompany Ledger Sheet – captures invoices, payment initiation, and receipt details across entities.

Cash Pool Movement Sheet – records central pool inflows and outflows by currency and date.

Each row in these sheets includes unique transaction IDs to link related movements (e.g., EUR customer payment → USD conversion → distribution to India).

Step 2 – Match Transactions Across Entities Using Pivot Tables

Because QuickBooks instances do not “talk” to each other, the team exports trial balances, bank statements, and intercompany ledgers from all four entities monthly. They then use pivot tables and lookup functions (VLOOKUP or INDEX/MATCH) to pair transactions that represent the same event.

For example:

EUR 200,000 received by UK entity on 28-Mar

Converted to USD 216,000 and credited in Singapore pool on 01-Apr

$100,000 redistributed to India on 05-Apr

These three entries are linked in the workbook, showing a full cash movement path with a clear settlement timeline.

Step 3 – Introduce “Timing Difference Accounts” in QuickBooks

Each subsidiary’s QuickBooks ledger includes special timing difference accounts:

FX Settlement in Transit

Intercompany Transfers in Transit

Pool Transfer Clearing Account

When a payment is initiated but not yet settled, it is posted to a “Transit” account. On settlement, it is reversed and posted to the final account. This ensures books reflect in-transit cash flows transparently.

Example – UK to US service charge payment:

UK books on initiation (31-Mar):

Date | Account | Debit | Credit |

31-Mar | Intercompany Payable – US | £75,000 | |

31-Mar | Bank | £75,000 |

US books on settlement (03-Apr):

Date | Account | Debit | Credit |

03-Apr | Bank | $94,000 | |

03-Apr | Intercompany Receivable – UK | $94,000 |

The three-day gap is tracked in the workbook and documented as a timing difference in the consolidation notes.

Step 4 – Manual Consolidation Adjustments

At quarter-end, the finance team prepares a detailed timing difference reconciliation schedule by currency and transaction type. An excerpt might look like:

Transaction | Original Currency | Amount | Initiated | Settled | Lag Days | Reason |

EUR-INV-489 | EUR | 200,000 | 28-Mar | 01-Apr | 4 | FX clearing delay |

IC-UK-US-31 | GBP | 75,000 | 31-Mar | 03-Apr | 3 | Cross-border settlement |

Pool-SG-IN-14 | USD | 100,000 | 05-Apr | 06-Apr | 1 | Bank holiday delay |

This schedule becomes part of the group’s quarterly reporting pack and is shared with auditors.

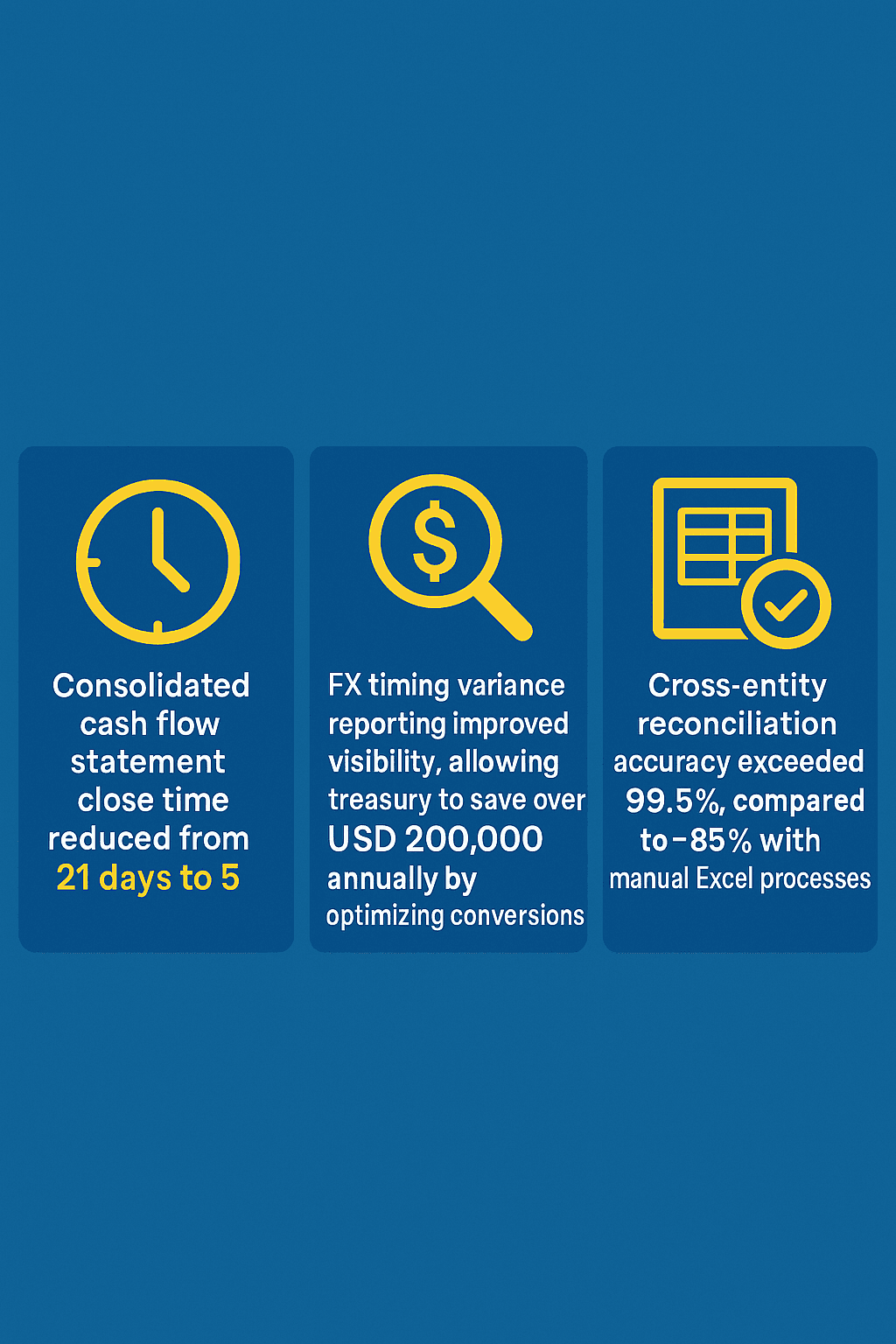

Solution with Finbaord.ai

NovaCore integrated all four QuickBooks Online instances into FinBoard.ai, which became the central engine for cross-entity cash flow alignment. Using its multi-currency mapping feature, FinBoard.ai tagged and linked transactions that represented the same underlying cash event, even when they were posted days apart and in different currencies.

The platform’s timing difference ledger maintained both economic transaction dates and settlement dates, giving the CFO visibility into lag effects across the group. FX movements were automatically layered into the cash flow statement, showing how much variance came from exchange rate changes versus actual timing gaps.

FinBoard.ai also automated reconciliation against bank statements imported into Google Sheets. Each transaction was matched across entities, currencies, and accounts, with unmatched items highlighted for review. Recurring intercompany eliminations, such as engineering service charges, were automated using tagging rules.

Tool / Workflow Comparison (high level)

Need | Excel/Sheets | Consolidation tool (Finboard.ai) + Google sheets | QuickBooks Online native |

Cost | Low | Medium–High | Low |

Intercompany auto-elims | No | Yes | No |

Audit trail | Weak | Strong | Moderate |

FX settlement handling | Manual | Built-in options | Manual |

Scalability | Low | High | Low |

FAQ

Q1: Why do reconciled entity banks not match consolidated cash?

A: Because intercompany flows and timing differences are not removed automatically when you add entity balances. Consolidation needs explicit elimination and timing alignment.

Q2: Will Spreadsheet Sync fix this?

A: Spreadsheet Sync helps combine P&L and BS, but it does not automate intercompany eliminations or normalized settlement dates. Use it as input, not the solution.

Q3: How should I treat a payment that crosses midnight?

A: Agree a posting policy: use bank settlement date as the group as-of date or the entity posting date, but apply consistently. Document the policy.

Q4: Are there banks that make this simpler?

A: Bank practices vary; some banks provide remittance and settlement reports that help. Use bank statements with settlement dates and match to those.

Glossary

Cash-in-transit (CIT): Temporary clearing account used until bank settlement occurs.

Intercompany register: Central log of cross-entity cash movements and required eliminations.

Settlement date: Date bank actually posts the movement.

Posting date: Date transaction recorded in an entity’s ledger.