Goodwill is indeed an intangible asset—but unlike other intangibles, it can’t be sold or separated from the business.

It arises during acquisitions when the purchase price exceeds the fair value of net identifiable assets.

Under US GAAP, goodwill is not amortized but tested for impairment; under IFRS, it follows a similar treatment with more flexibility in grouping assets.

Real-world SaaS examples show how goodwill can fluctuate due to retention rates, brand equity, and customer relationships.

Tools like FinBoard.ai can automate the entire goodwill tracking, impairment testing, and acquisition reconciliation process straight from your accounting data.

Executive Summary

If you’ve ever wondered why companies pay far more than “book value” when acquiring another business, the answer lies in one word—Goodwill.

Goodwill represents those intangible forces—brand trust, loyal customers, recurring revenue, and technical expertise—that don’t show up directly in the balance sheet but still drive enterprise value.

In accounting terms, goodwill is an intangible asset that arises when a company acquires another entity for a price higher than the fair value of its identifiable net assets.

It’s not about the furniture, laptops, or servers—it’s the reputation, relationships, and synergies that justify paying a premium.

This article breaks down how goodwill is measured, tracked, and tested under US GAAP and IFRS, explains real-life SaaS acquisition scenarios, and highlights how modern finance automation tools like FinBoard.ai are redefining how companies manage goodwill over time.

By the end, you’ll see how goodwill isn’t just an accounting entry—it’s a living reflection of your company’s strategic value and investor confidence.

1. Understanding Goodwill: The Intangible That Speaks Volumes

Let’s start with the simplest version.

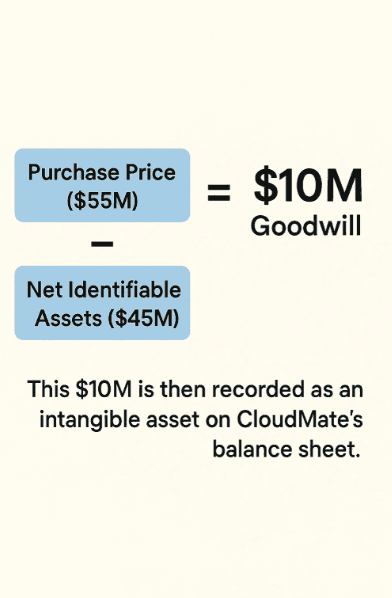

Suppose a SaaS firm—CloudMate Inc.—acquires another analytics startup, DataLoom, for $55 million. After due diligence, CloudMate’s finance team determines that the fair value of DataLoom’s identifiable net assets (servers, IP, contracts, deferred revenue, etc.) totals $45 million.

So where did the extra $10 million go?

That’s Goodwill.

It represents what CloudMate believes DataLoom’s brand, loyal clients, subscription renewal rates, and engineering team are truly worth in the long run. It’s that non-quantifiable premium that drives future earnings.

In other words:

Purchase Price ($55M) − Fair Value of Net Assets ($45M) = Goodwill ($10M)

2. Why Goodwill Exists in Real Life

Think of goodwill as the bridge between what a business owns and what it’s truly worth.

If you’ve ever tried buying a local gym franchise or a SaaS platform with recurring clients, you know this—some assets just don’t appear on a balance sheet:

Loyal customers who stay year after year.

A talented development team.

A brand name that converts 30% better than competitors.

High Net Retention Rate (NRR) of 125% that drives predictable MRR growth.

These are intangible advantages that make an investor pay extra.

In SaaS, goodwill often arises during M&A when one platform absorbs another with:

Superior customer success systems (reducing churn),

Proprietary algorithms or API integrations, or

A loyal base of enterprise customers with low price sensitivity.

Goodwill, therefore, captures all these hidden levers of value creation.

3. How Goodwill Is Calculated (Step-by-Step)

Let’s unpack the mechanics.

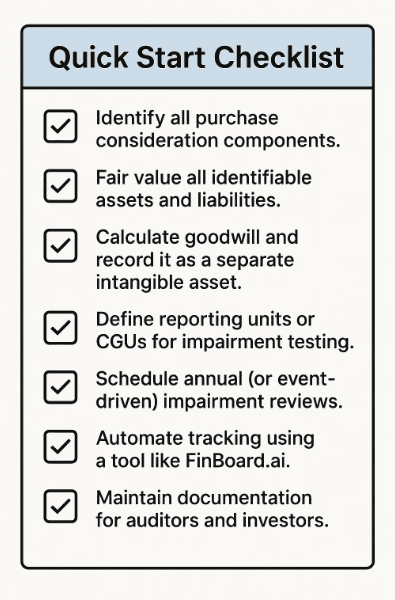

Step 1: Determine the Purchase Price

This includes:

Cash paid ($50 million),

Equity issued ($5 million),

Any contingent consideration (earn-outs or performance-linked payments).

Step 2: Identify and Fair Value All Assets and Liabilities

This includes both tangible (servers, furniture) and identifiable intangible assets like:

Patents, customer lists, and technology.

Deferred revenue obligations.

Contract liabilities or outstanding debts.

Step 3: Calculate Net Identifiable Assets

Net Identifiable Assets = Fair Value of Assets − Liabilities.

Suppose that’s $45 million.

Step 4: Compute Goodwill

Purchase Price ($55M) − Net Identifiable Assets ($45M) = $10M Goodwill

This $10M is then recorded as an intangible asset on CloudMate’s balance sheet.

4. Goodwill Under US GAAP vs IFRS

Both US GAAP and IFRS recognize goodwill as an intangible asset, but they differ subtly in their treatment.

Aspect | US GAAP | IFRS |

Recognition | Arises when purchase price > fair value of net identifiable assets | Same |

Amortization | Not amortized; subject to annual impairment test | Not amortized; impairment test required |

Impairment Testing | At reporting unit level (can be subsidiary or segment) | At cash-generating unit (CGU) level |

Reversals of Impairment | Not permitted | Permitted under specific conditions |

Presentation | Always shown as a separate line under intangibles | Same |

Impairment Test Example

Let’s continue the CloudMate story.

A year later, macroeconomic headwinds hit. DataLoom’s customer churn increases, and the fair value of its reporting unit drops from $55M to $48M.

Since the carrying amount of assets (including $10M goodwill) is now higher than the recoverable value, CloudMate must record a $7M goodwill impairment loss.

This goes straight to the P&L, reducing net income and possibly impacting future valuations.

5. Real-World SaaS Scenarios

Let’s make this more grounded.

Here are three realistic SaaS scenarios illustrating how goodwill works in practice.

Case 1: The Classic “Premium for Promise” Acquisition

Scenario:

A growing CRM SaaS company, SalesCloud.io, acquires a smaller competitor DealTrackr for $80 million.

DealTrackr’s net assets are worth $60 million on a fair value basis.

However, SalesCloud.io believes the following justify the premium:

A 97% customer retention rate,

Proprietary AI lead scoring model,

20 enterprise contracts with multi-year commitments.

Goodwill Recorded:

$80M − $60M = $20M

Practical Takeaway:

This goodwill represents synergies and customer relationships that don’t sit on DealTrackr’s books. Over time, if these contracts continue to renew and expand, goodwill stays intact.

But if churn rises or the “AI advantage” fades, SalesCloud.io must test and possibly impair part of that $20M.

Case 2: Post-Acquisition Slowdown and Impairment

Scenario:

Six months post-acquisition, SalesCloud.io notices DealTrackr’s renewal rates slipping from 97% to 85%. The integration also led to key team exits.

Fair value assessment now shows that the unit’s recoverable amount dropped to $70M, while carrying value (including goodwill) is $80M.

Action:

A $10M impairment is recognized, effectively writing down the goodwill.

Takeaway:

Impairment doesn’t mean failure; it’s an honest reflection of value erosion. SaaS markets fluctuate fast, especially with high CAC or rising churn.

Case 3: The Global Expansion Deal (Cross-Currency)

Scenario:

A US-based subscription billing platform, Finlytics Inc., acquires a UK-based analytics firm, DashIQ Ltd, for $40 million (paid in USD).

The identifiable net assets of DashIQ are £26 million, equivalent to $33 million at the acquisition-date exchange rate.

Goodwill recorded = $7 million.

However, in the following year, the pound strengthens, making the translated value of DashIQ’s net assets $36 million.

Does that change goodwill?

No. Goodwill remains at $7 million in USD, but the foreign currency translation adjustment ffects consolidated equity.

Takeaway:

Cross-currency acquisitions introduce translation risks—but goodwill remains fixed in acquisition-currency terms unless impaired.

6. How FinBoard.ai Simplifies Goodwill Accounting

Traditional accounting systems—like QuickBooks Online —handle acquisitions, but goodwill tracking and impairment testing are often messy and manual.

That’s where FinBoard.ai steps in.

It acts as a smart data layer that syncs your ERP, M&A schedules, and valuation inputs directly to an FP&A dashboard. Here’s what it does practically:

Automates Goodwill Calculation: It extracts purchase price allocations and compares fair value adjustments across reporting units automatically.

Tracks Impairment Signals: By integrating with forecasting data and KPIs like NRR, churn, or ARR decline, it triggers impairment alerts proactively.

Cross-Currency Management: FinBoard handles multi-entity, multi-currency goodwill seamlessly, adjusting translation differences and generating GAAP-compliant reports.

Audit-Ready Documentation: Creates schedules and memos automatically for auditors—no more manual spreadsheets.

For a SaaS CFO juggling multiple acquisitions, FinBoard.ai becomes the silent engine ensuring transparency and compliance without touching previously reported revenue periods.

7. Common Questions CFOs Ask About Goodwill

Q1: Why can’t goodwill be amortized like other intangibles?

Because it has an indefinite useful life. It’s not tied to a specific patent expiry or contract duration. Instead, it represents ongoing business reputation and relationships.

Q2: Can goodwill ever increase?

Not directly. Accounting standards only allow downward revisions (impairment). Any perceived increase in value will be realized only when you sell the business.

Q3: How often must goodwill be tested for impairment?

At least annually, and more frequently if triggering events occur—like customer churn, market downturn, or loss of a key customer.

Q4: Is negative goodwill possible?

Yes, it’s called a bargain purchase gain. It occurs when an acquirer pays less than the fair value of the target’s net assets, often due to distress sales.

Q5: How does goodwill affect investors’ perception?

Large goodwill balances raise questions about acquisition discipline. Frequent impairments can signal poor integration or overvaluation, so investors track it closely.

8. Risks and Mitigations

Risk | Description | Mitigation |

Overvaluation | Paying too much based on hype or unverified synergies. | Conduct fair value assessments and sensitivity analysis. |

Integration Failure | Culture or system mismatches reduce expected benefits. | Build structured post-merger integration plans. |

Impairment Blind Spots | Late detection of declining unit value. | Continuous monitoring with KPI-linked triggers via FinBoard.ai. |

Currency Volatility | FX movements distort consolidated goodwill. | Use natural hedging and entity-level reporting in base currency. |

Audit Scrutiny | Inconsistent valuation assumptions across acquisitions. | Maintain consistent valuation methodologies and documentation. |

9. Glossary

Goodwill: The excess of purchase price over the fair value of identifiable net assets in a business combination.

Impairment: Reduction in asset carrying value when recoverable amount falls below book value.

Purchase Price Allocation (PPA): The process of assigning fair values to acquired assets and liabilities.

Cash Generating Unit (CGU): Smallest identifiable group of assets that generates independent cash flows under IFRS.

Reporting Unit: Equivalent concept under US GAAP, often aligned to segments.

Contingent Consideration: Future payments linked to performance metrics in an acquisition.

Bargain Purchase: When consideration is less than fair value of net assets (negative goodwill).

Translation Adjustment: Impact of currency fluctuations on foreign subsidiaries’ financials.

FinBoard.ai: Financial intelligence platform that automates accounting, valuation, and FP&A workflows across systems.

Final Thought

Goodwill isn’t just an accounting adjustment—it’s a reflection of what the market believes your business really brings to the table.

Handled correctly, it tells a story of growth, synergy, and strategy. Handled poorly, it can become a red flag for investors and auditors alike.

With tools like FinBoard.ai, companies no longer need to fear the complexity of goodwill accounting. Instead, they can harness it—turning acquisition data, valuation assumptions, and operational KPIs into a single, audit-ready financial intelligence layer.