QuickBooks Online does not calculate carbon emissions.

Carbon accounting happens through third-party apps that use QuickBooks Online data.

The quality of emissions data depends entirely on accounting discipline.

Most errors come from poor chart design, messy vendors, and rushed mappings.

Accountants play a critical role in making ESG numbers credible.

Executive Summary

Many accountants are now hearing the same question from clients:

“Can we track our carbon emissions in QuickBooks?”

The short answer is no.

The longer, more useful answer is: QuickBooks can supply the data, but it cannot do the calculation.

Carbon emissions are not accounting outputs. They are estimates derived from financial activity. QuickBooks Online records spending, vendors, categories, and timing. Carbon accounting tools take that information and translate it into emissions using standardized conversion factors.

Most frustration arises when clients assume ESG reporting works like a P&L. It does not. There is no “carbon report” button in QuickBooks. There is no US GAAP requirement embedded in the software. Everything depends on how well the accounting data is structured before it ever reaches a sustainability tool.

This article explains how carbon measurement using QuickBooks Online actually works, where people go wrong, and how accountants can set it up in a way that stands up to scrutiny without overengineering the books.

What Clients Mean When They Ask for “Carbon Accounting in QuickBooks”

Clients rarely ask precise questions. When they say they want carbon accounting in QuickBooks, they usually mean one of the following:

A customer has asked for emissions data.

A lender or investor wants ESG disclosures.

The company wants to appear sustainability-focused

Someone read that ESG reporting is “coming soon.”

None of these imply that QuickBooks needs to change. They imply that the data inside QuickBooks must be usable.

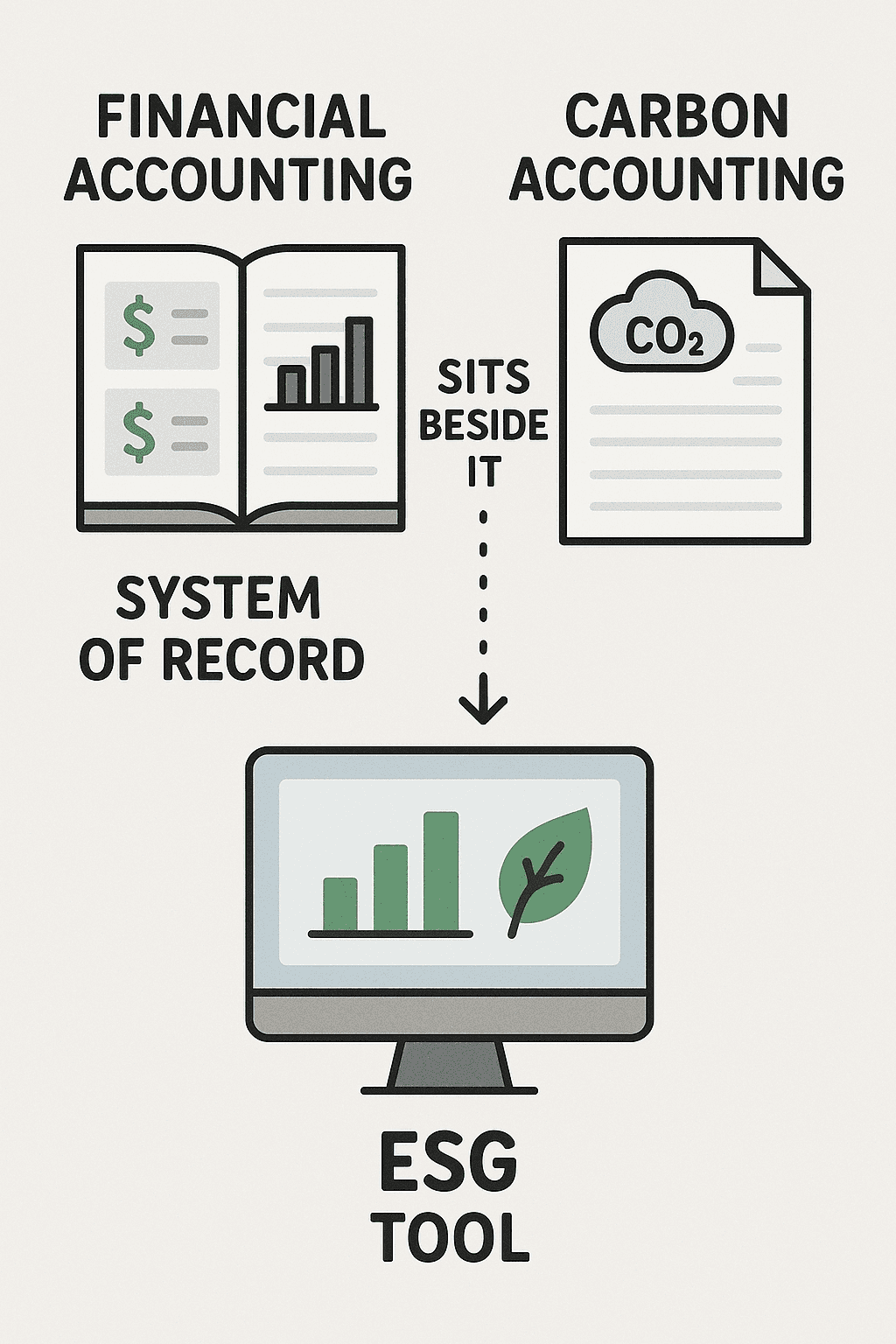

Carbon accounting does not replace financial accounting. It sits beside it. The accounting system remains the system of record. ESG tools are downstream consumers of that data.

Once this framing is clear, most confusion disappears.

What QuickBooks Online Can and Cannot Do

What QuickBooks Can Do Well

Capture transaction-level spend data

Classify expenses by account, vendor, date, and amount

Maintain audit trails and locked periods

Serve as a reliable source of historical activity

What QuickBooks Cannot Do

Identify physical activity like kilowatt hours or miles traveled

Apply emissions factors

Distinguish between renewable and non-renewable energy automatically

Produce ESG disclosures or sustainability statements

Any solution promising “native carbon accounting inside QuickBooks Online” should be treated with skepticism.

How Carbon Accounting Tools Use QuickBooks Data

Carbon accounting tools connected to QuickBooks follow a fairly mechanical process.

Data extraction

The tool pulls expenses, bills, and credit card transactions.Categorization

Transactions are grouped by account, vendor, or item.Emission factor application

Each category is assigned an emissions factor based on industry databases.Aggregation

Emissions are summed by month, category, or scope.

The tool does not understand context. It does not read invoices like a human. It relies on signals from the accounting structure.

If the signals are weak, the output will be unreliable.

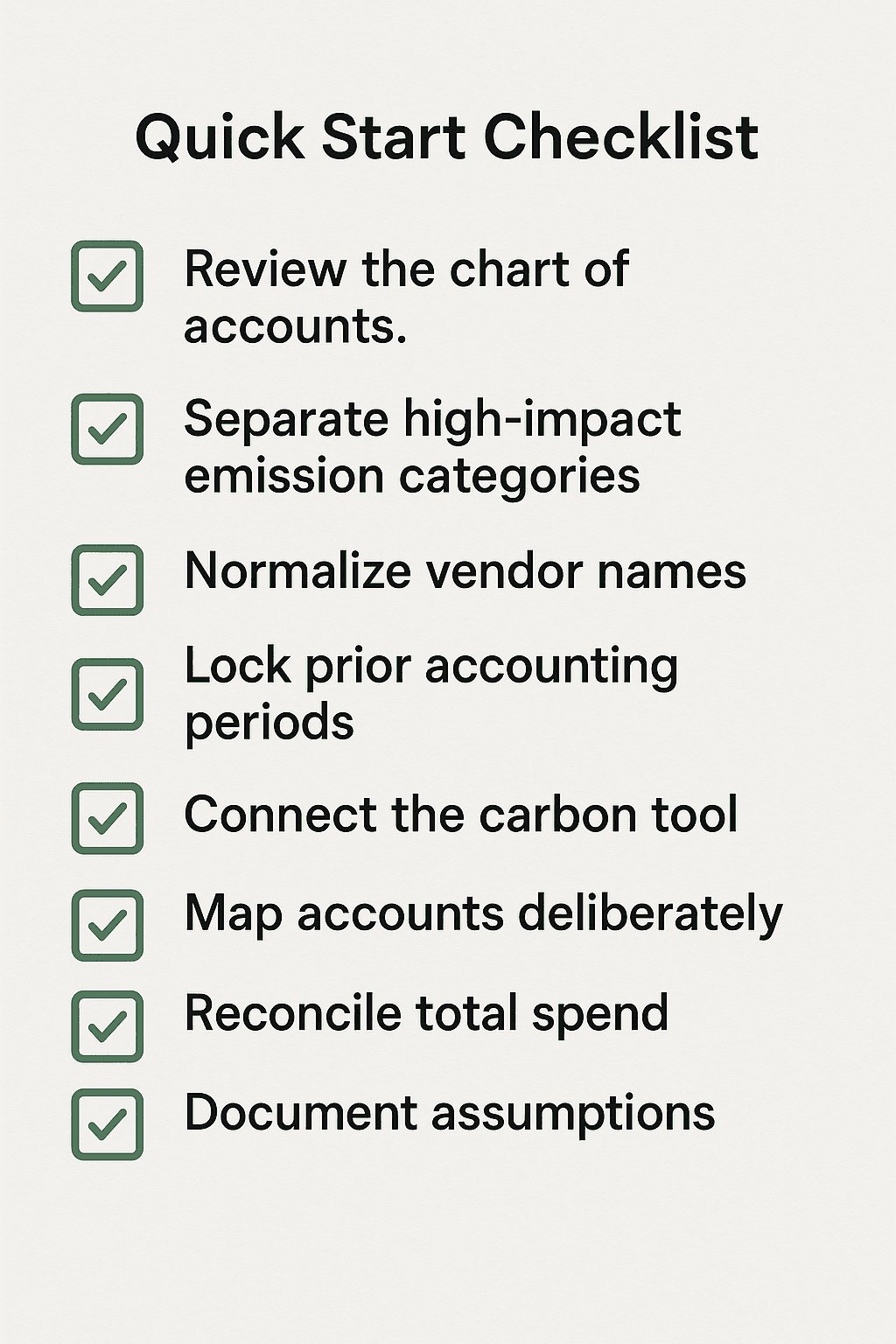

The Real Reason ESG Numbers Go Wrong

Most ESG reporting problems are accounting problems in disguise.

Problem 1: Overly Generic Expense Accounts

If electricity, gas, fuel, and water all sit under “Utilities,” the carbon tool has no way to distinguish emissions types.

From an accounting perspective, this may be acceptable. From a carbon perspective, it is useless.

Problem 2: Inconsistent Vendor Usage

Carbon tools often rely on vendor classification.

When the same supplier appears under five names, emissions get fragmented or misclassified.

Problem 3: Auto-Categorization Without Review

Bank rules and auto-posting save time, but they also destroy semantic meaning.

Speed comes at the cost of data quality.

Designing a Chart of Accounts That Supports Carbon Measurement

You do not need a complex chart. You need a purposeful one.

Minimum Recommended Expense Separation

At a minimum, separate:

Electricity

Natural gas

Fuel

Air travel

Freight and logistics

Purchased goods and materials

This does not mean exploding the chart. It means avoiding meaningless aggregation.

Explain to clients that this is not “for ESG.”

It is for better information.

Vendors Matter More Than Most Accountants Realize

In traditional accounting, vendor naming is often treated as cosmetic.

In carbon accounting, it is functional.

Best practices:

One vendor, one name.

Use parent entities where possible.

Avoid free-text variations.

This improves both ESG outputs and AP controls. It is a rare win-win.

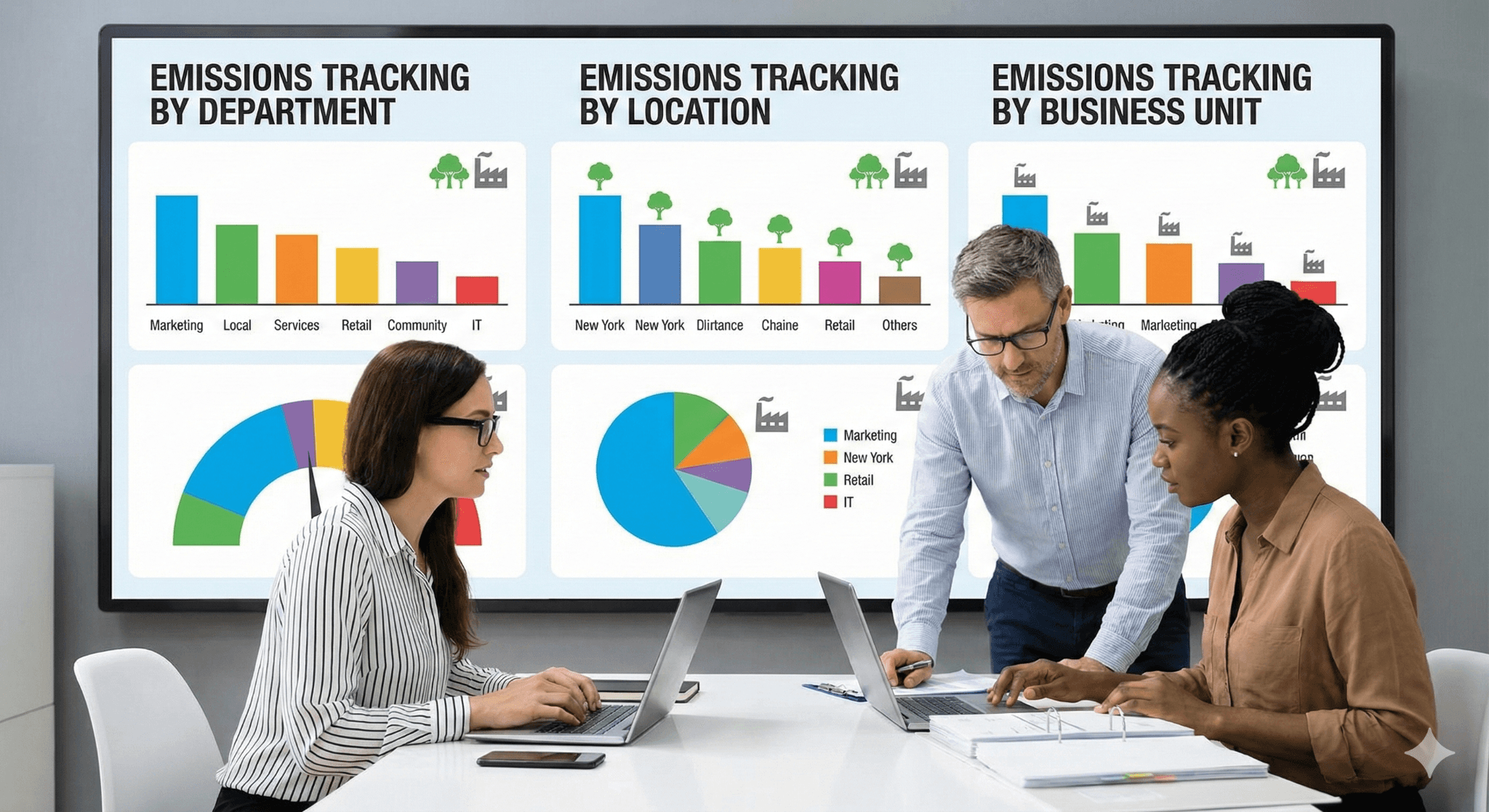

Classes, Locations, and the Temptation to Overuse Them

Classes and locations can help, but they introduce complexity.

Before using them, ask:

Are they already used for profitability?

Will ESG reporting conflict with management reporting?

Who will maintain the discipline?

If the answer is unclear, do not proceed.

Carbon data does not need dimensional perfection. It needs consistency.

Connecting a Carbon Accounting App to QuickBooks

Most connections happen through the QuickBooks App Store.

The technical connection is easy. The conceptual setup is not.

The Most Important Step: Account Mapping

During setup, the app will ask how each expense account should be treated.

This is where accountants add value.

Do not accept defaults blindly. Sit with the chart of accounts. Ask what each account really represents. Adjust mappings until they make sense.

Rushing this step guarantees rework later.

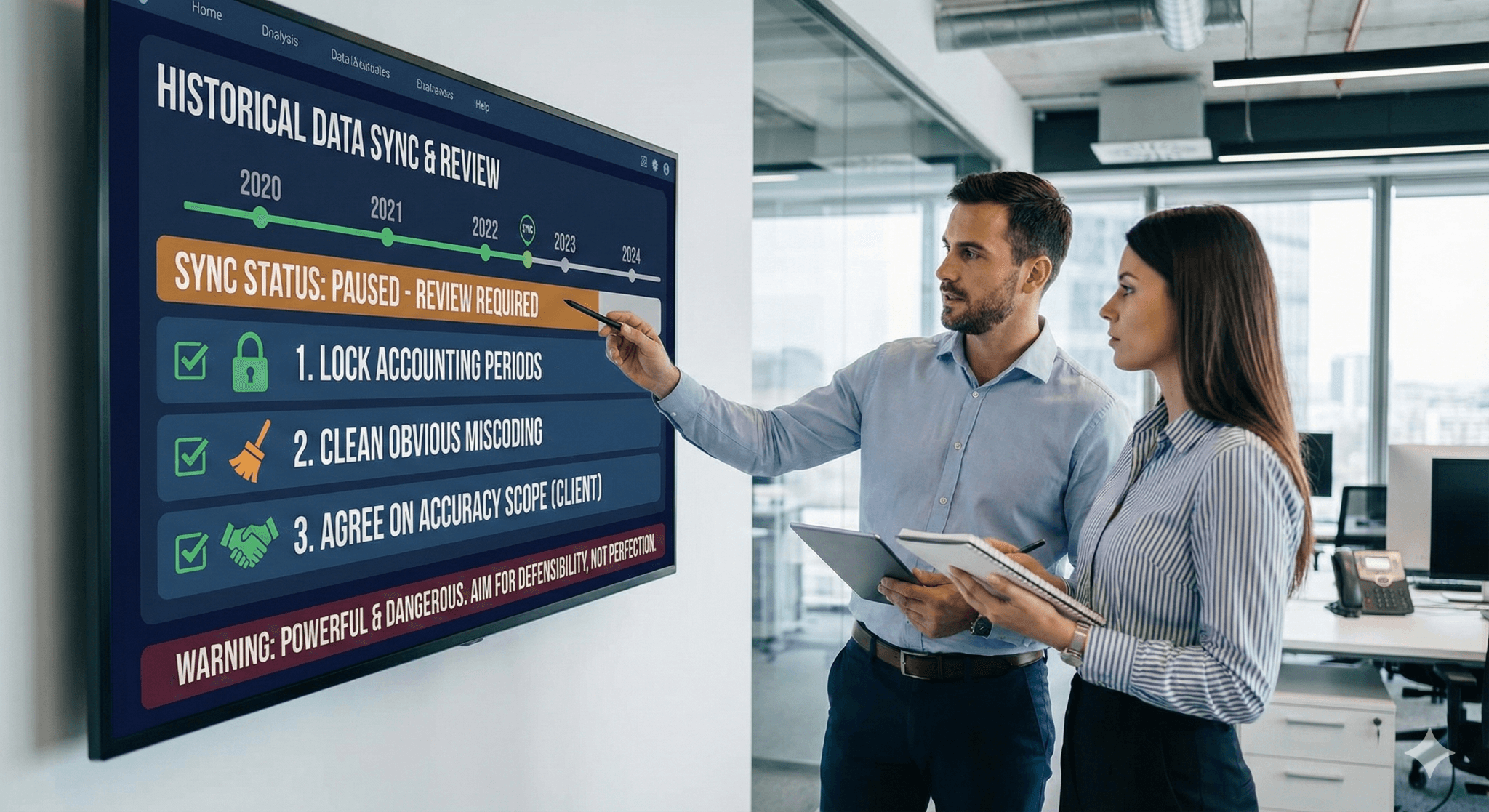

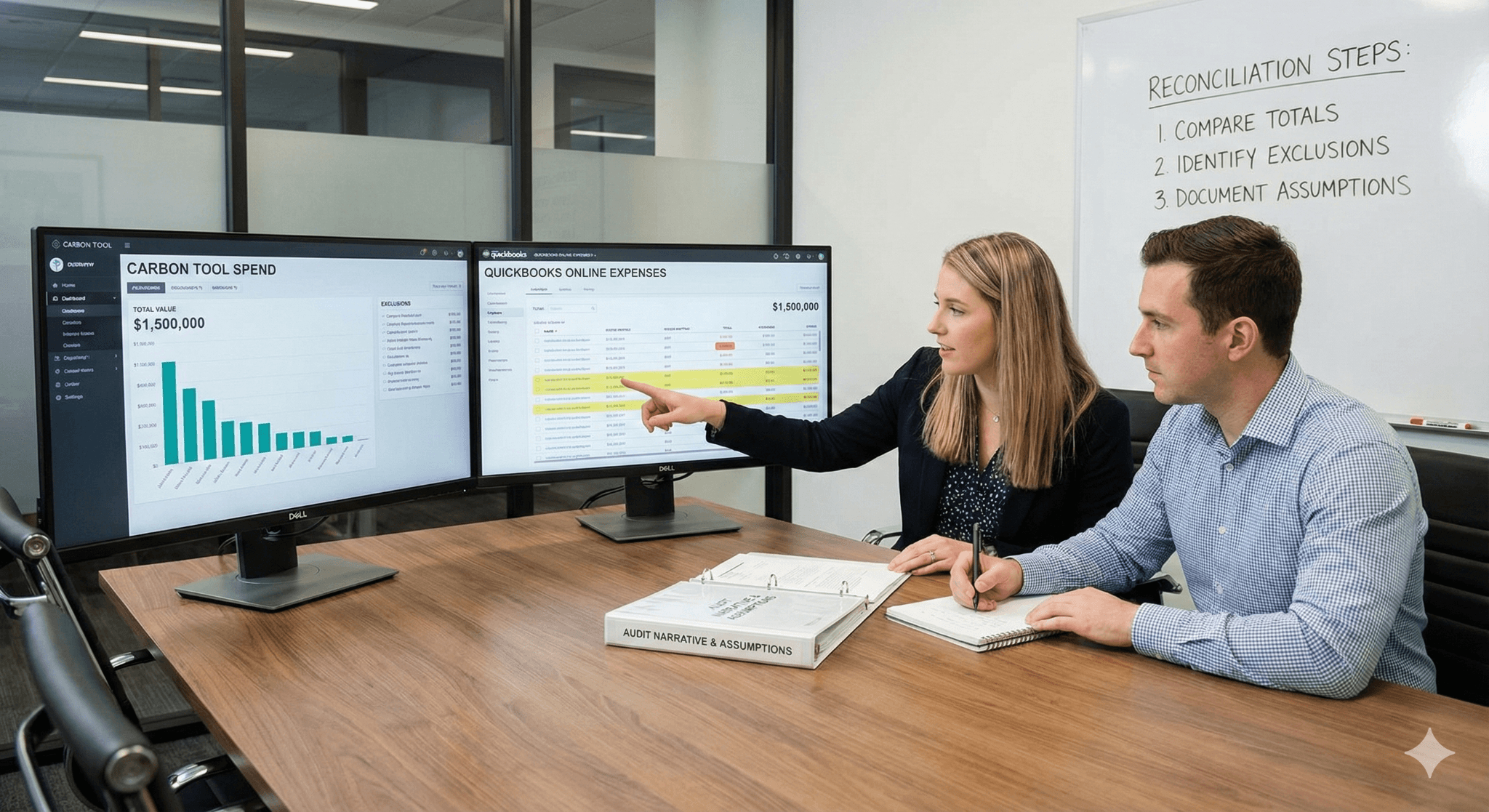

Reconciling ESG Inputs to the General Ledger

A common controller concern is reconciliation.

Mini-Case Study: Professional Services Firm

Background

A 60-person consulting firm needed emissions data for a European client.

Initial Setup

Carbon app connected quickly. Results looked low.

Diagnosis

Travel expenses were split between airfare, meals, and “reimbursements.” Fuel was miscoded. Utilities were generic.

Fix

Created dedicated travel and fuel accounts.

Cleaned vendor list.

Remapped categories.

Outcome

Emissions increased significantly. The client accepted the number because the logic was transparent.

Trust improved once the accounting improved.

Managing Client Expectations Around Accuracy

Carbon numbers feel scientific. They are not exact.

Accountants should explain:

Emissions are estimates.

Factors are standardized, not company-specific.

Comparability matters more than precision.

Clients who understand this are far easier to work with.

Common Workarounds and Why They Backfire

Excel-Only ESG Models

They seem easy. They are fragile.

Problems:

No audit trail

Version control issues

Manual reconciliation every period

Excel has a role, but not as the system of record.

Manual Adjustments Outside QuickBooks

Some teams adjust ESG data without adjusting accounting.

This creates divergence.

Once ESG and financial data tell different stories, credibility suffers.

Risks and How Accountants Can Mitigate Them

Risk: Regulatory Misinterpretation

Clients may think ESG numbers are GAAP-mandated.

Mitigation:

Clarify that ESG reporting is outside US GAAP financial statements.

Risk: Overengineering for Small Clients

Not every SMB needs detailed Scope 3 analysis.

Mitigation:

Start simple. Expand only when required.

Risk: Tool Dependency

Clients may assume the app “handles everything.”

Mitigation:

Position the tool as a calculator, not a brain.

Workflow Comparison

Approach | Sustainability Insight | Accounting Integrity | Long-Term Viability |

QuickBooks Online + FinBoard.ai | High | High | High |

Spreadsheet Only | Medium | Low | Low |

Estimates Only | Low | Low | Very Low |

Frequently Asked Questions

Can QuickBooks ever support ESG natively?

Possibly, but today it does not.

Is this required for audits?

Not under US GAAP today.

Do carbon numbers affect financial statements?

No. They are separate disclosures.

Who owns ESG data internally?

Often finance, with operations input.

Is this worth doing for small companies?

Only if there is a business reason.

Glossary

Carbon Accounting

Estimating emissions from business activity using standardized factors.

Emission Factor

A ratio converting activity or spend into emissions.

Scope 1, 2, 3

Categories of emissions based on source and control.

System of Record

The authoritative source for a data set, usually accounting.